The

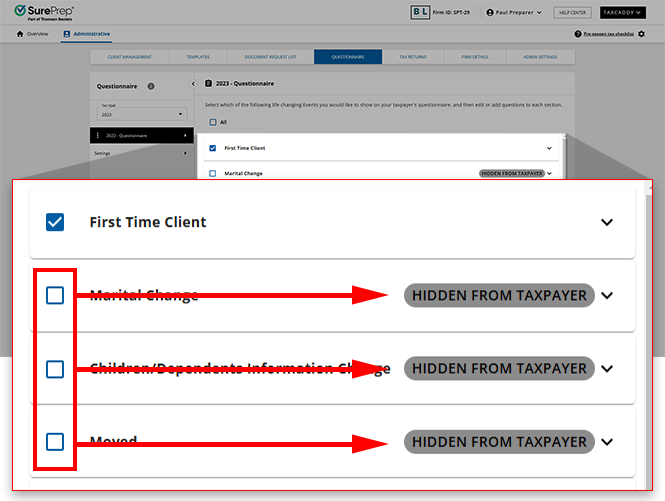

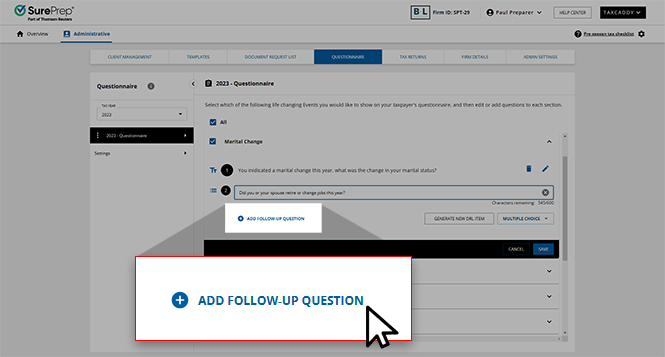

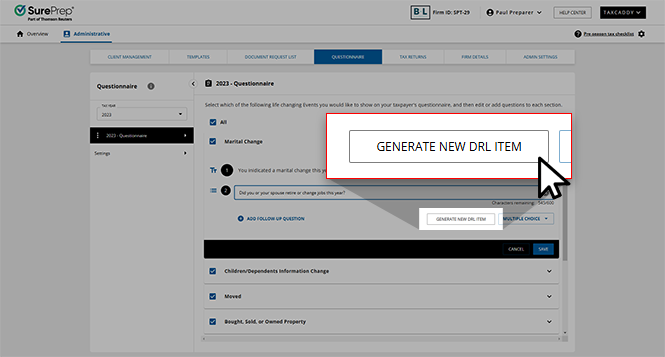

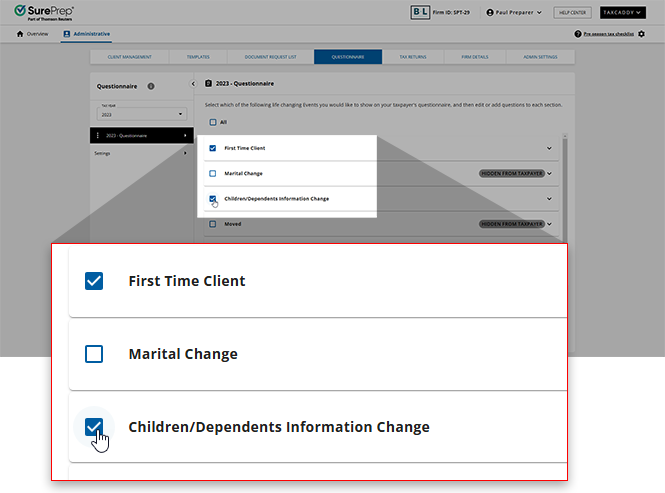

Questionnaire

feature allows you to prepare a generic template with questions that can be bulk sent to multiple clients. By default, TaxCaddy already provides you with a questionnaire template that you can use to customize questions that go out to your clients. You can customize the questionnaire template by adding, editing, or deleting questions.

) badge.

) badge.