Release notes for 25.12.1

note

The next release for ONESOURCE Sales and Use Tax Compliance Version 26.01.1 is scheduled for release on January 30, 2026.

What’s changed

Forms revisions

If a multiple location version of a return listed below exists in ONESOURCE Sales and Use Tax Compliance, the revisions have been applied to that return as well.

- Alabama Local, Helena Tax Return

- Kentucky, 51A102 Sales & Use Worksheet P2

- Kentucky, 51A103 Accelerated S&U Worksheet P2

- Louisiana Local, Claiborne Parish, Sales & Use Tax Report

- Louisiana Local, Concordia Parish, Sales & Use Tax Report

- Louisiana Local, Saint James Parish, Sales & Use Tax Report

- Rhode Island, T-205. Consumer’s Use Report

- Virginia Local, Town of Grottoes, Meal Tax Report

- Virginia Local, Town of Louisa, Meals Tax Return

State notes

All of the following changes were incorporated into the applicable returns and accompanying schedules for that state or locale. Listed changes are effective

December 1, 2023

, unless noted otherwise.Interest rate changes

JURISDICTION | FROM | TO |

|---|---|---|

Florida | 12.000% | 11.000% |

Indiana | 6.000% | 7.000% |

Kentucky | 10.000% | 9.000% |

Maine | 10.000% | 9.000% |

Michigan | 8.660% | 8.480% |

New Hampshire | 10.000% | 9.000% |

Administrative Changes

Alabama Locals

- Beatrice and Beatrice Police Jurisdiction changed administration from RDS/Avenu to ADOR.

- Lee County changed administration from RDS/Avenu to ADOR.

- Snead changed administration from RDS/Avenu to ADOR.

Washington

The Washington Form 2406 will include the new

Service

, Other Activity

, and applicable deduction

lines for amounts of $5 million and over

.Tax rate changes

All of the following tax rate changes were incorporated into the application. Listed changes are effective December 1, 2025, unless noted otherwise.

Alabama Locals

- Beatrice imposed rental tax rates for General Rental and Auto Rental of 4.00%. Beatrice Police Jurisdiction imposed rental tax rates for General Rental and Auto Rental of 2.00%.

- Helena increased general sales and use tax rates from 4.000% to 5.000%; Machinery and equipment sales and use tax rates from 1.330% to 1.660%; auto sales and use rates increased from 1.330% to 1.660%. Helena Police Jurisdiction increased general sales and use tax rates from 2.000% to 2.500%; Machinery and equipment sales and use tax rates from 0.6650% to 0.8300%; auto sales and use rates increased from 0.6650% to 0.8300%.

- Sumter County (7060) increased general sales and use tax rates from 3.000% to 4.000%; Machinery and equipment sales and use tax rates from 1.500% to 2.000%; auto sales rates increased from 1.750% to 2.250%; and auto use rates increased from 1.5000% to 2.000%.

Virginia Locals:

Town of Grottoes increased Meals Tax rate from 5.500% to 6.000%

Town of Louisa increased Meals Tax rate from 5.500% to 6.000%.

Application updates

Available Forms for each supported return

ONESOURCE Sales and Use Tax already has an Effective Date filter in the 'Tax Returns' content tool, along with a count of forms available for each supported return. This count is now a hyperlink to open a list of those forms, allowing users to refer to this content tool to find out what forms are covered by each tax return that ONESOURCE Sales and Use Tax supports as per the selected effective date.

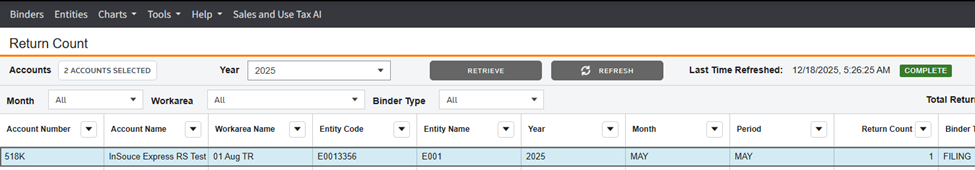

Account-level filtering on return count reports

The 'Return Count' tool has been enhanced to support account-level filtering, allowing client users to generate reports for multiple accounts with fewer clicks. This is especially useful for users who have access to more than one account.

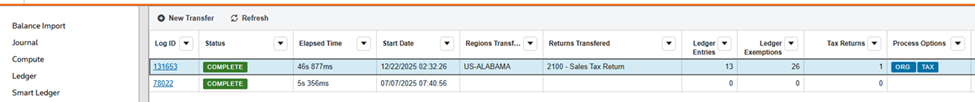

‘Tax Returns’ count must be 1 for return-level transfer requests

Client users can opt to transfer returns individually for each registered return. For such requests, the 'Tax Returns' count must be 1, as only one return can be selected per request.

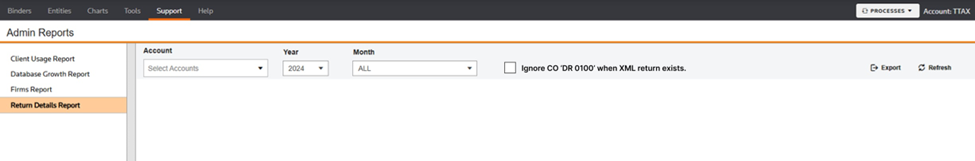

Ignore CO DR 0100 checkbox in Return Details Report

A new option has been added to 'Ignore CO DR 0100' when XML returns exist for the entity. This will help remove duplicate return counts.

What’s fixed

Louisiana Locals

The 1% EDD Tax for Washington Parish (columns A, C, and D) will no longer double on the single and multiple returns.

Texas

The print issue that occurred when reporting for a single outlet on form 01-114 with 01-116 supplement has been resolved in this release. The ‘x’s that previously obscured the state tax amount on line 4 have now been moved to the local tax amount on line 5.

Issue with the credits and suspensions aging report

The credits and suspensions aging report is not working and the same is reported to us. We have provided a fix for the same in this release. For more details on the reported issue, refer the Support Request 4811205 Aging Report not working

What’s coming

General Availability of D2C Tax Merge

The ‘D2C Tax Merge’ feature of OSU is already live and enabled for few of the accounts who participated in the pilot phases. This feature will now be available for all the relevant accounts. You can refer to the Help Document for more info about this feature and accordingly, reach out to your TR Representative to get this feature enabled for your accounts.