2025 Tax code to Form 1042-S income code mapping

Overview of 2025 changes for Form 1042-S

Box 7d - a new checkbox has been added to indicate a Form 1042-S is being filed to revise an amount subject to withholding in a withholding rate pool to report to a specific recipient.

New chapter 3 status codes 40 (Partnership QDD) and 41 (U.S. government entity or tax exempt entity (other than section 501(c) entities)) have been added.

New income codes 59 (Consent fees), 60 (Loan syndication fees), and 61 (Settlement payments) have been added.

Country code - 'US' is now a valid country code entry in box 12f (withholding agent) or 13b (recipient).

For 2025 (Revenue Procedure 2024-42), Armenia and Uruguay are new to the list of countries for which bank deposit is required to be reported for nonresident alien individuals.

Mapping of ONESOURCE Trust Tax income codes to Form 1042-S income codes

1042-S income code | Description | ONESOURCE Trust Tax code | Chapter 3 tax rate | Chapter 3 exemption code | Chapter 4 exemption code |

|---|---|---|---|---|---|

01 Interest paid by U.S. obligors-general | Tax-exempt interest | 11, 83, 85, 121, 123, 124, 136, 137, 447, 448, 497, 498 | N/A | 2-Exempt under IRC | 15-Payee not subject to chapter 4 withholding (refer to Note 5) |

Interest 01 paid by U.S. obligors-general | Domestic non-portfolio interest | 7, 8, 9, 13, 55, 86, 92, 107, 183, 184, 185, 186, 224, 226, 228, 493, 494, 496 where the Asset Non-portfolio interest income flag was set | Rate determined from tax treaty table 1, Income Code Number 1 column (refer to Note 4) | No exemption code | 15-Payee not subject to chapter 4 withholding |

01 Interest paid by U.S. obligors-general | Domestic portfolio interest (refer to Note 1) | 7, 8, 9, 13, 55, 86, 92, 107, 183, 184, 185, 186, 224, 226, 228, 493, 494, 496 where the Asset Non-portfolio interest income flag was not set | N/A | 5-Portfolio interest exempt under IRC | 15-Payee not subject to chapter 4 withholding |

02 Interest paid on real property mortgages | Excess inclusion income | 84 | Rate is 30% | No exemption code | 15-Payee not subject to chapter 4 withholding |

04 Interest paid by foreign corporations | Foreign interest (refer to Note 2) | 10, 227, 495 | N/A | 3-Income is not from U.S. sources | 15-Payee not subject to chapter 4 withholding |

06 Dividends paid by U.S corporation - general | U.S. Corporation dividends (refer to Note 1) | 1, 5, 6, 114, 132, 163, 500, 502, 503, 599 | Rate determined from tax treaty table 1, Income Code Number 6 column (refer to Note 4) | No exemption code | 15-Payee not subject to chapter 4 withholding |

06 Dividends paid by U.S corporation - general | U.S. Corporation dividends from foreign source | 2, 520 | N/A | 3-Income isnot from U.S. sources | 15-Payee not subject to chapter 4 withholding |

06 Dividends paid by U.S corporation - general | Dividends from 80/20 companies | 98 | N/A | 2-Exempt under IRC | 15-Payee not subject to chapter 4 withholding (refer to Note 5) |

06 Dividends paid by U.S corporation - general | Section 897 Capital Gains | 164 | Rate is 30% | No exemption code | 15-Payee not subject to chapter 4 withholding |

08 Dividends paid by foreign corporations | Foreign dividends (refer to Note 2) | 3, 501 | N/A | 3-Income is not from U.S. sources | 15-Payee not subject to chapter 4 withholding |

09 Capital gains | Distributed capital gains | System default is to populate only if the Include capital gains on Form 1042-S Computer-Federal option is selected. This includes all distributed capital gains (excluding those related to tax codes 99 and 157) | Rate is 30% | No exemption code | 15-Payee not subject to chapter 4 withholding (refer to Note 5) |

09 Capital gains | 302 Merger Delivery vs. Payment | 99 (if distributed) | N/A | 2-Exempt under IRC | 15-Payee not subject to chapter 4 withholding |

14 Real property income and natural resources royalties | Real property income and natural resources royalties | Passive rental/royalty income. Rental/royalty income with material participation may or may not be included depending on Compute-Federal option selection. | Rate is 30% | No exemption code | 15-Payee not subject to chapter 4 withholding |

23 Other income | Other income | 44, 60, 89, 90, 472, 473 plus state overpayment applied. Also, any portfolio ordinary gain would be included in this amount. | Rate is 30% | No exemption code | 15-Payee not subject to chapter 4 withholding |

27 Publicly traded partnership distributions subject to IRC section 1446 | Partnership income | Ordinary income from a publicly traded partnership (refer to Note 6). | Rate is 37% | No exemption code | 15-Payee not subject to chapter 4 withholding |

29 Deposit interest | Deposit interest (refer to Note 3) | 51 | N/A | 2-Exempt under IRC | 15-Payee not subject to chapter 4 withholding |

30 Original issue discount (OID) | Original issue discount | 158, 162, 169, 192, 193, 196, 197, 215, 216, 217, 218, 348, 349, 506 | N/A | 5-Portfolio interest exempt under IRC | 15-Payee not subject to chapter 4 withholding |

33 Substitute payment-interest | Substitute payment-interest | 95 | Rate/exemption same as for portfolio interest | N/A | 15-Payee not subject to chapter 4 withholding |

34 Substitute payment-dividends | Substitute payment-dividends | 96 | Rate determined from tax treaty table 1, Income Code Number 6 column (refer to Note 4) | No exemption code | 15-Payee not subject to chapter 4 withholding |

35 Substitute payment-other | Substitute payment-other | 97 | Rate is 30% | No exemption code | 15-Payee not subject to chapter 4 withholding |

36 Capital gains distribution | Capital gain not subject to NRA Withholding | 156, 157 (if distributed) | N/A | 2-Exempt under IRC | 15-Payee not subject to chapter 4 withholding (refer to Note 5) |

37 Return of capital | Nondividend distributions | 4 | N/A | 2-Exempt under IRC | 15-Payee not subject to chapter 4 withholding (refer to Note 5) |

40 Other dividend equivalents under IRC section 871(m) (formerly 871(l)) | 871M dividend | 134 | Rate determined from tax treaty table 1, Income Code Number 6 column. | No exemption code | 15-Payee not subject to chapter 4 withholding |

57 Amount realized under IRC section 1446(f) | Section 1446(f) proceeds subject to withholding | 526, 527 (refer to Note 6) | Rate is 10% | No exemption code | 15-Payee not subject to chapter 4 withholding |

57 Amount realized under IRC section 1446(f) | Section 1446(f) proceeds not subject to withholding | 528, 529 (refer to Note 6) | N/A | Exemption code based on recipient Chapter 3 status | 15-Payee not subject to chapter 4 withholding (refer to Note 5) |

57 Amount realized under IRC section 1446(f) | Additional excess cumulative net income (ECNI) | 530 If simple/complex trust or estate, selection section 1446(f) checkbox on sales screen may also be used | Rate is 10% | No exemption code | 15-Payee not subject to chapter 4 withholding |

58 Publicly traded partnership distributions - undetermined | Publicly traded partnership distributions - undetermined | 139 (refer to Note 6) | Rate is 37% | No exemption code | 15-Payee not subject to chapter 4 withholding |

Note 1

Includes interest and dividend amounts from Schedule K-1s.

Note 2

Interest paid by foreign corporations (income code 04) and dividends paid by foreign corporations (income code 08) is not reported on Form 1042-S if the

Suppress reporting of foreign interest and dividends

1042-S Control option was selected.Note 3

Bank deposit interest is required to be reported to any nonresident alien individual who is a resident of a foreign country with which the United States has agreed to exchange tax information pursuant to an income tax treaty, other convention or bilateral agreement.

ONESOURCE Trust Tax automatically reports bank deposit interest on Form 1042-S for nonresident individuals whose country of residence meets the requirements indicated above. The list of countries is included in Revenue Procedure 2024-42.

To report bank deposit interest for all nonresident alien individuals regardless of their foreign country of residence, select the

Report bank deposit interest paid to nonresident individuals on Form 1042-S even if reporting is not required based on country of residence

Compute-Federal option.note

If the recipient Chapter 4 status code is set to

15-Nonparticipating FFI

, and the recipient's Documentation not available or invalid selected

checkbox is marked, then the bank deposit interest is automatically reported (subject to 30% withholding under Chapter 4) regardless of the recipient's residence.Note 4

The "Tax Treaties" section of IRS Publication 515 includes the following link to the tax treaty tables:https://www.irs.gov/individuals/international-taxpayers/tax-treaty-tables.

Note 5

The chapter 4 exemption code for these income types may be set to 21 (Other payment not subject to chapter 4 withholding). Refer to the "Chapter 4" section below for more information.

Note 6

NRA recipients receive a separate Form 1042-S for each type of reportable income associated with a given publicly traded partnership (PTP). Information from the PTP asset record (name, EIN, etc.) will be used to populate box 16 (Payer information) of each Form 1042-S generated. No assumptions are made regarding the payer Chapter 3 and 4 status. The system does not automatically assume the Chapter 3 status for a payer is 38.

Example: Recipient receives $100 of partnership income (tax code 12) and $20 of PTP distributions - undetermined (tax code #139) from PTP A. Recipient also receives $400 of partnership income (tax code 12) from PTP B. As a result, 3 Form 1042-S would be generated for the NRA recipient as follows:

- 1st 1042-S - Income code 27 with gross income of $100, withholding at 37%

- 2nd 1042-S - Income code 58 with gross income of $20, withholding at 37%

- 3rd 1042-S - Income code 27 with gross income of $400, withholding at 37%

Tax rate comments

1-If the recipient's

Documentation not available or invalid selected

checkbox is selected, then all reportable income not subject to an exemption will have a Chapter 3 tax rate of 30% applied. This includes portfolio interest as instructed in IRS Publication 515 (refer to Presumption Rules). This takes precedence over the recipient Chapter 3 status code checks listed below. If the recipient Chapter 4 status code is set to 15-Nonparticipating FFI

, see the Chapter 4 comments below.2-If a recipient's

No election made to receive treaty rates

checkbox is selected, then all income otherwise subject to treaty rates will have a Chapter 3 tax rate of 30% applied.3-If the

Recipient eligible for special treaty dividends with benefits

checkbox is selected and if U.S. corporate dividends would otherwise be subject to reduced treaty rates based on recipient country, then Chapter 3 exemption code 04 (Exempt under tax treaty) would apply with no withholding required (a 0% dividend withholding rate would be in effect).4-If a recipient Chapter 3 status code is set to 19 (International Organization), 20 (Tax-exempt organization (Sectionn 501(c) entities)), 36 (Foreign Government-Integral Part), or 37 (Foreign Government-Controlled Entity), then no tax rate is applied.

5-If a recipient Chapter 3 status code is 18 (Private Foundation), then a Chapter 3 tax rate of 4% is applied.

6-If none of the above exceptions are met and the recipient country is not listed in the Publication 515 table, then a default tax rate of 30% is applied.

Exemption logic exceptions

1-If a recipient Chapter 3 status code is set to 19 (International Organization), 36 (Foreign Government-Integral Part) or 37 (Foreign Government-Controlled Entity), then the Chapter 3 exemption code is set to 24 (Exempt under section 892).

2-If a recipient Chapter 3 status code is 20 (Tax-exempt organization (Section 501(c) entities)) then the Chapter 3 exemption code is set to 2 (Exempt under IRC).

3-If a recipient Chapter 3 status code is 09 (Withholding Foreign Partnership) or 11 (Withholding Foreign Trust), then the Chapter 3 exemption code is set to 7 (WFP or WFT).

Box 3

In compliance with the Form 1042-S instructions, either 3 or 4 (not both) will need to be entered on each Form 1042-S. Per the IRS, if amounts are not reported in boxes 7 through 9, then

3

should be entered in this box.Chapter 4

If the recipient Chapter 4 status code is set to

15-Nonparticipating FFI

and the recipient's Documentation not available or invalid selected

checkbox is marked, then all income is subject to Chapter 4 reporting and a Chapter 4 tax rate of 30% is applied (the Chapter 3 exemption will be set to 12 (Payee subjected to chapter 4 withholding)). This includes any bank deposit interest (recipient country situs does not impact reporting for Chapter 4 purposes).Otherwise, if no Chapter 4 information (rate or exemption code) for a given income code is entered, then all such income is assumed subject to Chapter 3 (either a Chapter 3 tax rate or exemption is applied). If the income is subject to Chapter 3 (the system default), then 15 (Payee not subject to Chapter 4 withholding) is printed in Box 4a (unless otherwise indicated in Note 5) and 00.00 is printed in Box 4b.

If either a Chapter 4 tax rate or exemption code is entered, then 12 (Payee subjected to Chapter 4 withholding) is printed in Box 3a and 00.00 is printed in Box 3b.

Income codes 51, 52, 53, and 54

Income codes 51, 52, 53, and/or 54 are used if income (interest or dividends) was paid and a reduced rate or withholding under an income tax treaty is claimed by the recipient does not provide a U.S. or foreign TIN.

If the recipient does not have a TIN and either the applied chapter 3 tax rate is reduced to less than 30% under an income tax treaty or the chapter 3 exemption code is 04 (Exempt under tax treaty), then ONESOURCE Trust Tax makes the following income code revisions:

- Interest described by income code 01 (Interest paid by U.S. obligors-general) is changed to income code 51.

- Dividends described by income code 06 (Dividends paid by U.S. corporation-general) is changed to income code 52.

- Dividends described by income code 34 (Substitute payment-dividends) is changed to 53.

- Interest described by income code 33 (Substitute payment-interest) is changed to 54.

note

The income code changes are not made to income when a chapter 3 exemption applies (unless the chapter 3 exemption code is 04), or if the withholding rate is 30%.

For example, a recipient from China has a U.S. TIN of FORM1042S, and no foreign TIN is specified. Dividends paid by a U.S. corporation to this recipient are $1,000. According to table 1 of IRS Publication 515, a 10% withholding rate is applied on dividend income for a recipient from China.

Since the recipient's U.S. TIN is not valid and the withholding rate on the dividend income is less than 30%, income code 52 (Dividends paid on certain actively traded or publicly offered securities) is used rather than income code 06 (Dividends paid by U.S. corporations-general).

note

Income code revisions do not occur if the income code is entered in the

1042-S Additional Income

collapsible section at the recipient level. If, for example, income code 06 was entered in this collapsible section, ONESOURCE Trust Tax would not change it to income code 52 even if the withholding rate was less than 30% and no recipient TIN was provided.Rounding

IRS Form 1042-S Instructions indicate "You must round off cents to whole dollars." All amounts reported on the actual Form 1042-S and consolidated Form 1042-S (if generated as a withholding agent copy or part of a projection) are rounded to whole dollars. Amounts filed with the IRS are rounded as well, and are the same as thos reported on the printed output. For example:

- Asset A generates Dividends paid by U.S. corporations-general (income code 06) of $4.20.

- Asset B generates Dividends paid by U.S. corporations-general (income code 06) of $6.40.

- The recipient receives 100% of income. All dividends noted above are subject to 30% withholding. Asset-level detail for income is generated when the account is processed.

When the Compute-Federal option is set to prepare the return with dollars, the 1042-S form/filing indicates $10 of gross income (the dividends from each asset is rounded so that there is $4 for Asset A and $6 for Asset B). Withholding is then computed. The result is $3 (30% of $10).

When the Compute-Federal option is set to prepare the return with cents, the 1042-S form/filing indicates $11 of gross income (the total amount of $10.60 is rounded to $11). Withholding is then computed. The result is $3 (30% of $11, or $3.33 rounded to the nearest dollar).

Unique form identifier

The IRS (Form 1042-S instructions) requires that withholding agents assign a 10 digit numeric unique identifying number to each Form 1042-S they file. ONESOURCE Trust Tax automatically generates this number for each 1042-S generated. It prints on both the IRS substitute Form 1042-S and the consolidated Form 1042-S output (if generated) and is included with information filed with the IRS.

Form 1042-S output

Publication 1179 instructs that Copies A, B, C, and D of Form 1042-S cannot contain multiple income types for the same recipient. Per the IRS, "Only one Form 1042-S may be submitted per page, regardless or orientation." As such, the substitute form only includes one Form 1042-S per page (rather than 2 per page). The substitute Form 1042-S generates in portrait orientation.

The consolidated Form 1042-S format may no longer be generated/included in the beneficiary packet when a tax return is processed.

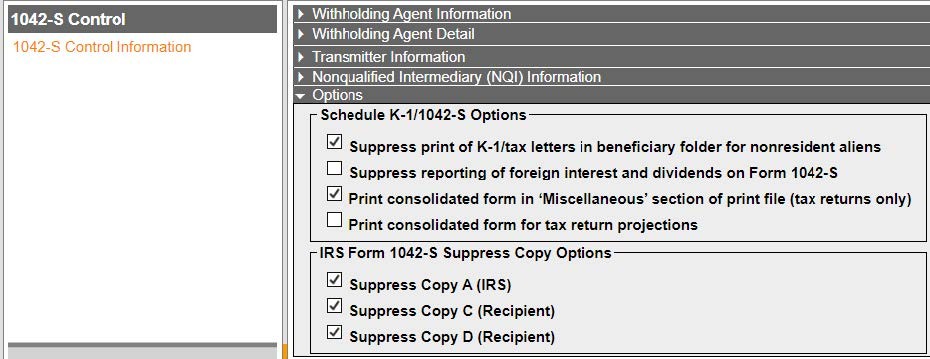

The following graphic shows the 1042-S Control options available for selection:

- Copy A (for the IRS)-This copy automatically generates unless suppressed by selecting theSuppress Copy A (IRS)1042-S Control option. The option to suppress Copy A should be selected unless you plan to paper file the form with the IRS. If generated, the form is included in the Miscellaneous section of the print file.

- Copy B (for the recipient)-This copy is always generated and included in the Beneficiary section of the print file.

- Copy C (for the recipient to attach to federal tax return)-This copy automatically generates unless suppressed by the selection of theSuppress Copy C (Recipient)1042-S Control option. If generated, the form is included in the Beneficiary section of the print file.

- Copy D (for the recipient to attach to state tax return)-This copy auotmatically generates unless suppressed by the selection of theSuppress Copy D (Recipient)1042-S Control option. If generated, the form is included in the Beneficiary section of the print file.

- Form 1042-S recipient instructions are included in the Beneficiary section for each recipient a Form 1042-S was generated for.

note

- Since copies B, C, and D are included in the Beneficiary section of the print file, they (along with the Form 1042-S instructions) are available for Mail Service.

- If thePrint consolidated form for tax return projections1042-S Control option is selected, then the consolidated version of the 1042-S is included in the Beneficiary section of the print file. It is not included in the Miscellaneous section.

Corrections print

Form 1042-S AMENDED Box

The AMENDED box on Form 1042-S is marked when:

- TheType of 1042-S (for printed form only)dropdown list is set toAmended. This dropdown list is in the Form 1042-S Recipient Information collapsible section on the Recipient Detail page.

- An amendment number is indicated in the AMENDMENT NO. box on Form 1042-S.

note

The system may mark the AMENDED box even though the Form 1042-S is being electronically filed.

UNIQUE FORM IDENTIFIER and AMENDMENT NO. Fields

The IRS requires a 10-digit Unique Form Identifier (UFI) to be assigned to each Form 1042-S return that is filed. The UFI applies to original and amended Form 1042-S returns. An amended Form 1042-S must have the same UFI as the original Form 1042-S that is being amended. ONESOURCE Trust Tax automatically generates the UFI during processing.

The IRS requires an amendment number in addition to the UFI for any amended Form 1042-S that is filed.

For corrections print, ONESOURCE Trust Tax determines the UFI and amendment number based on the following criteria:

- No change-If there are no changes to an originally filed Form 1042-S then the UFI is the same as the originally filed Form 1042-S. The Form 1042-S AMENDMENT NO. box is blank.

- Change to an originally filed Form 1042-S. If there is a change to an originally filed Form 1042-S, then the 1042-S return generated in the corrections print has the same UFI as that originally filed. A "1" prints in the Form 1042-S AMENDMENT NO. box.ONESOURCE Trust Tax defines any of the following as a change to an originally filed Form 1042-S:

- Only amounts (gross income and/or withholding) chnaged from the original filing.

- Only the income code changed from the original filing.

- The income code and gross income are the same as the original filing.

- New Form 1042-S-If there is a new Form 1042-S that was not originally filed then the new Form 1042-S generated in the corrections print has a different UFI. The AMENDMENT NO. box for the new Form 1042-S is blank. Any Form 1042-S generated during corrections print that does not meet the criteria included in the two bullet items above is considered a new Form 1042-S.

Printing corrected Form 1042-S with no gross income

A corrected or revised Form 1042-S with no gross income reportable for a given income code can be generated by selecting the

Force 1042-S with No Gross Income (Corrections only)

checkbox, which is available under the 1042-S Income Overrides

and 1042-S Additional Income

collapsible sections on the Recipient Detail page.