You can choose the settings for Tax Exempt Income allocation for state purposes. The muni-bond data is captured based on your firm-wide settings or customized on individual binders. This article will highlight the criteria for matching securities that determine if the security is marked state-taxable or non-taxable.

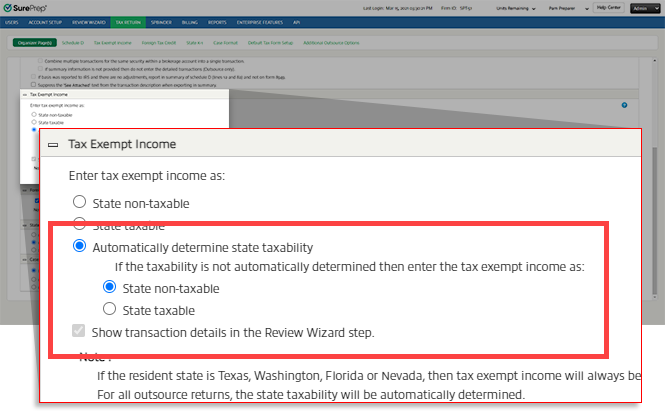

You can decide from one of the three options:

SurePrep automatically determines state taxability

When creating a binder, firm-level options are selected by default across the firm. However, you can select a different option when creating a binder.

Tax Exempt Income: Automatically determine state taxability

Auto-calculation of Muni Bond Interest as State Taxable/Non-Taxable for Tax Exempt Dividends/Interest and Bond Premium:

If the

Automatically determine state taxability

option is selected, then 1040SCAN completes the following steps to match the security descriptions with a predefined list, in the Pre-Verification process.

The ability to automatically determine state taxability begins processing for new binder around Feb 15th of the calendar year.

The security descriptions are displayed in the Verification Wizard as per the following criteria:

Security Description matches with the predefined list

Recognition of Security Description based on state

'Security Description' matches with the predefined list

When the security description on the source document matches the security description provided in the predefined list, an

icon is placed to the right side of the

Security Description

. The

icon indicates that the system has automatically calculated the percentage in the

EXEMPT % OR AMOUNT

column based on the amount captured by the OCR in the

State Exempt Amount

column.

You can point to the

icon to see the tooltip:

Exempt% determined based on Description

.

The

icon disappears if the verifier manually edits a value in the '

EXEMPT % OR AMOUNT

' column.

The

Security Description

gets replaced automatically with the security description found in the predefined list.

If the

Security Description

matches with more than one security description from the predefined list, the highest matched security description among the two or more matches found will be considered for calculating the

EXEMPT % OR AMOUNT

value.

Recognition of Security Description based on State

1040SCAN will check for the proforma resident state code (Home State) and will consider that as a base state. Next, it will search for the base state name /state abbreviation /state short form within the

DESCRIPTION

field captured during the OCR process (i.e. California, CA).

Home State of California

Search for 'California' or 'CA' in the

DESCRIPTION

field.

A match must have a space after/before it. It should not have any spaces or special characters between them.

When the state name/abbreviation/short form is found, an

icon gets displayed on the right side of the

DESCRIPTION

field, indicating that the taxability is determined based on the state.

Use your mouse to point to the

icon to see one of the following messages:

Deemed Non-Taxable as Resident State is found in Description.

Deemed Taxable as Non-Resident State is found in Description.

Deemed Non-Taxable as Resident State is found in Description.

The taxability is determined based on the resident state. The

DESCRIPTION

is marked as state taxable/state exempt based on the resident state.

If the security description is matched with the proforma’d resident state then:

State Exempt Amount

field =

State Non Taxable

EXEMPT % OR AMOUNT

field = 1 (to indicate state non taxable)

In the

State Taxable

option checkmark will not be cleared.

For

Puerto Rico

,

Guam

,

Virgin Islands

, and

Samoa

, the

DESCRIPTION

field will be considered State Non Taxable:

State Exempt Amount

field =

State Non Taxable

EXEMPT % OR AMOUNT

field = 1 (to indicate state non taxable)

In the

State Taxable

option checkmark will not be cleared.

Deemed Taxable as Non-Resident State is found in Description.

If there is no resident state(s) in the security description, the taxability will be determined based on the Non-Resident state. The security description is marked as state taxable/state exempt.

If any state name/short form/abbreviation other than the resident state name is found in the security description, it will consider the 'State Exempt Amount' as 'State Taxable', with populating

0

in the

EXEMPT % OR AMOUNT

column and the

State Taxable

checkbox will be checked automatically.

If more than one state name/abbreviation is found from the security description, the resident state will be considered first for determining the taxability.

For example: If there exists a client with:

the proforma'd home state of

NJ

and a

DESCRIPTION

in which two state abbreviations are found (i.e.

NY

and

NJ

)

then the state abbreviation

NJ

will be considered because it is the resident state

and

it is the same state found in the security description. Consequently, the

State Exempt Amount

will be calculated as

Fully Exempt

.

For some specific resident states like FL, TX, NV, WA where determining the state taxability is not required, the amount inEXEMPT % OR AMOUNT will always be considered asState Non-Taxable.

The security descriptions that do not match the predefined security description, and were read as certain by the OCR will directly appear in the Verification wizard.

If none of the state name/abbreviations/short form is found in the security descriptions, and no proforma’d state information is provided, then the security description will be shown under the Verification Wizard and the amount will be shown in the

State Exempt Amount

column as

State Nontaxable

.

When the verifier corrects that description and to the next, the system will begin matching it to the security descriptions in the predefined list. The process will end once the verifier provides a value in the '

EXEMPT % OR AMOUNT

' field or moves on to the next security description.

The '

EXEMPT % OR AMOUNT

' field is editable. If the security description is state taxable then '0' appears automatically in that field along with a checkmark in the 'State Taxable' check box. Once you edit the '

EXEMPT % OR AMOUNT

' field, the checkmark for 'State Taxable' will be removed.

If you enter [0.1 to 1.0] in '

EXEMPT % OR AMOUNT

' field, it will be treated as an Exempt percentage and more than 1 will be treated as an Exempt amount. If you enter a negative amount, a message 'Invalid amount or %' is displayed.

Those security descriptions matched with the predefined list will have an icon on the right side of security description and those which are determined based on state will have an icon on the right side of the security description.

If the verifier clicks the 'Submit' option without verifying the uncertain security description, a message pops up for verification 'There are some uncertain fields to verify. Would you like to skip verification and continue?'

If the verifier clicks on the 'Yes' option, then all the uncertain security descriptions will get converted to certain, but will not be processed for the determination of taxability. Clicking the 'No' option will take the verifier to the uncertain security descriptions.

Alternatively, you can also change the security transactions as 'State Taxable' or 'State Exempt' manually by entering '0/0.1' in the field of '

EXEMPT % OR AMOUNT

' to make the whole State Exempt Amount as 'State Taxable'/ 'State Exempt' or can also enter the calculated exempt amount or percentage (should not be a negative amount) and the balance will be considered as 'State Taxable'.

If in some cases, descriptions appear in more than one line then the determination of taxability will not be applied.

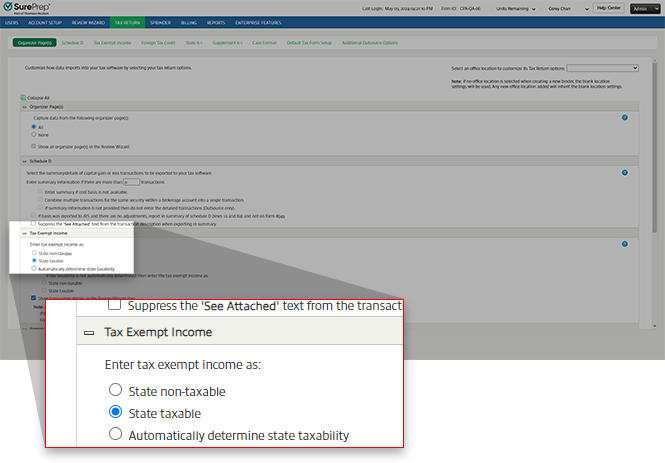

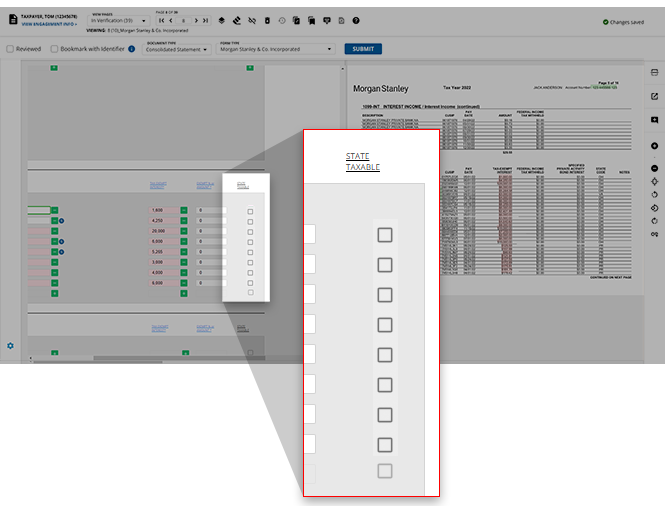

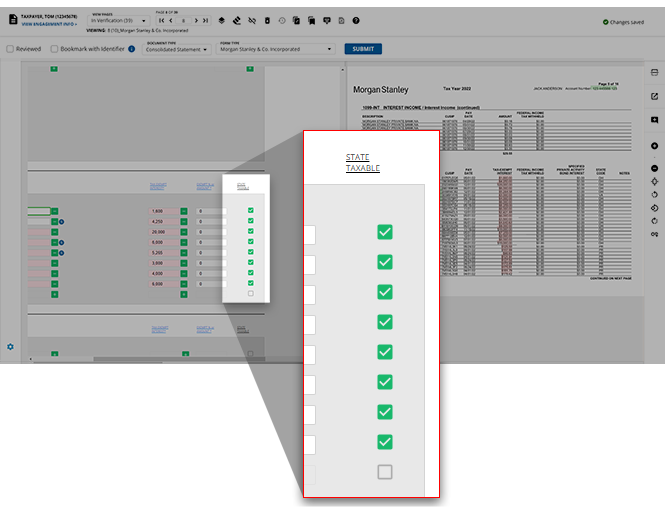

Tax Exempt Income: State non-taxable

When the

State non-taxable

option is selected in the

Create New Binder

window, or through the

Admin > TAX RETURN >

Tax Exempt Income

tab of FileRoom, then it will

not

follow the steps mentioned above.

The security descriptions as captured by the OCR appears in the

DESCRIPTION

field.

The

TAX-EXEMPT INTEREST

field will display the amount of the tax-exempt interest.

The

EXEMPT % or AMOUNT

field will populate with

1

indicating the amount as 'State Non Taxable'.

The

State Taxable

checkbox will be unchecked.

To change the security descriptions to

STATE TAXABLE

, you can select the STATE TAXABLE checkbox. As a result, the value in the corresponding

EXEMPT % or AMOUNT

field will automatically update to

0

.

If you enter any amount greater than

1

, it will be treated as an

EXEMPT AMOUNT

and the balance will be treated as

STATE TAXABLE

.

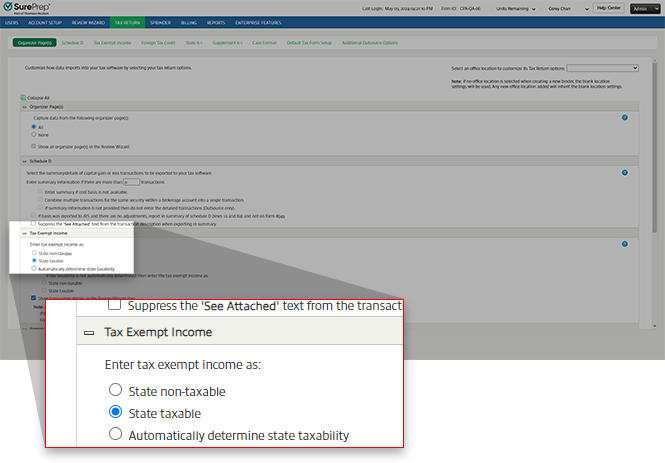

Tax Exempt Income: State taxable

When the

State taxable

option is selected in the

Create New Binder

window, or through the

Admin > TAX RETURN >

Tax Exempt Income

tab of FileRoom, then it will

not

follow the steps mentioned above.

The security descriptions captured by the OCR will appear in the

DESCRIPTION

fields.

The

TAX-EXEMPT INTEREST

field will display the amount of the tax-exempt interest.

The

EXEMPT % or AMOUNT

field will populate with

0

indicating the amount as

State Taxable

.

STATE TAXABLE

checkboxes will be selected.

To change the security transactions as State Non-Taxable, you can enter [0.1 - 1] and it will be treated as a percentage equal to or more than 1, and the same will be treated as an exempt amount, but it should be less than or equal to the State Exempt Amount. This will deselect the

State Taxable

checkboxes.

If you enter the Exempt percentage or Amount in the 'Exempt% or Amount' field, the check mark will be removed and the State Exempt Amount will break down on the basis of the exempt percentage or the amount entered and the check box of the 'State Taxable' field will be inactive.

If the verifier does not verify the uncertain description in the Verification wizard and submits the wizard, then the same security transactions will be displayed in the Tax Exempt Interest Income Wizard.