Triva isn't available right now.

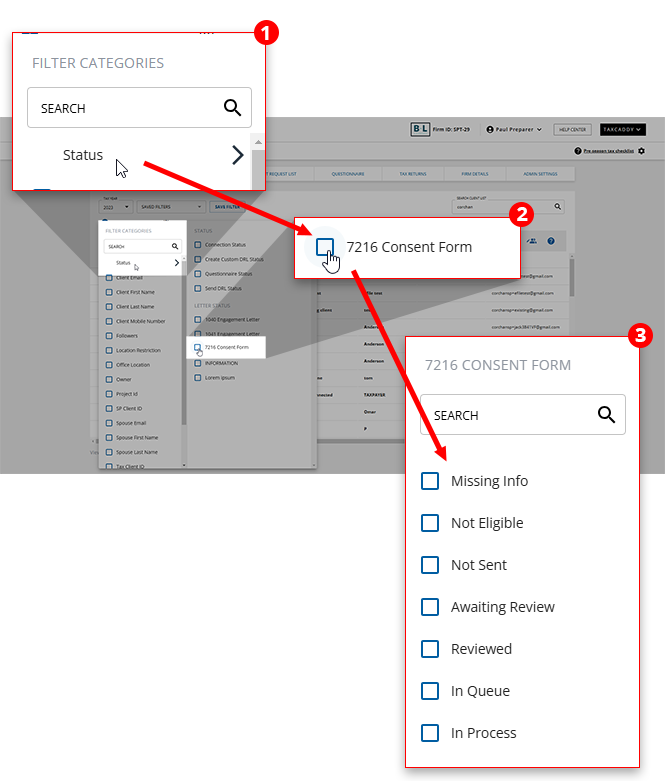

Letter Status | What can I do? | Description |

|---|---|---|

Missing Info | Nothing, provide missing tax info to proceed | You can't send Letters to clients with this status because their client record is missing info required to invite the client to use TaxCaddy. |

Not Eligible | Nothing, this account is not able to receive a Letter | Clients are not eligible for Letters if they are either Offline or Duplicate accounts. |

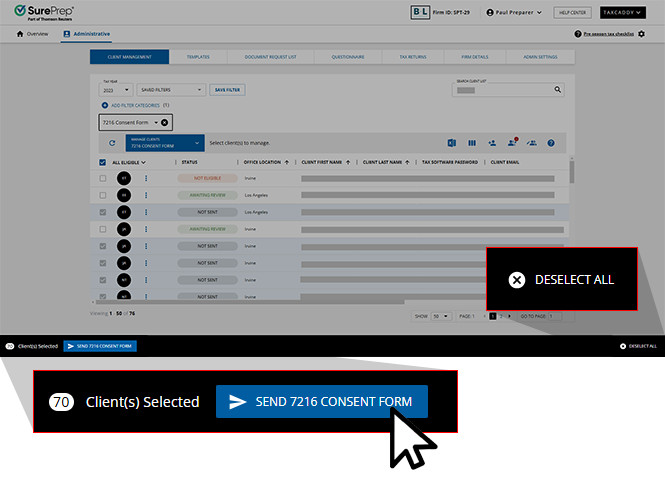

Not Sent | Send | TaxCaddy is ready to send the Letter. |

Awaiting Review | Wait for the client to provide a review | The Letter has been sent to the client and is awaiting review by the client. |

Awaiting Signature | Wait for the client to provide a signature | The Letter has been sent to the client and awaiting signature by the primary account holder (taxpayer). |

Awaiting Spouse's Signature | Wait for the client’s spouse to provide a signature | The Letter has been signed by the client/primary account holder (taxpayer) but is still awaiting signature by the client’s spouse. |

Manual Signature Required | Nothing, the client you'll need sign the document manually | If a client fails to verify their identity three times when signing with ID verification, you'll need to download the document and sign it manually. If either the taxpayer or spouse fails the identity verification, both are required to sign the document manually. |

Reviewed | Complete | View the completed item in the client’s Uploaded Tax Documents, under the category CPA Letters. |

Signed | Complete | View the completed item in the client’s Uploaded Tax Documents, under the category CPA Letters. |