In the latest analysis of our recent "State of the Legal Market 2023" report, we look at how law firms that invested strongly in associate compensation made out at the end of the day

Among the challenges described in the recently published 2023 Report on the State of the Legal Market, lawyer growth and retention were certainly top of mind for many law firm leaders. The talent wars that began in the second quarter of 2021 and carried through the majority of 2022 resulted in elevated compensation growth for all lawyers, but especially for associates.

This placed added pressure on firm profitability, and as we close the books on 2022 it has left us wondering: Was it worth it?

To help answer that question we evaluated the reasons for, and impact of, such fast compensation increases.

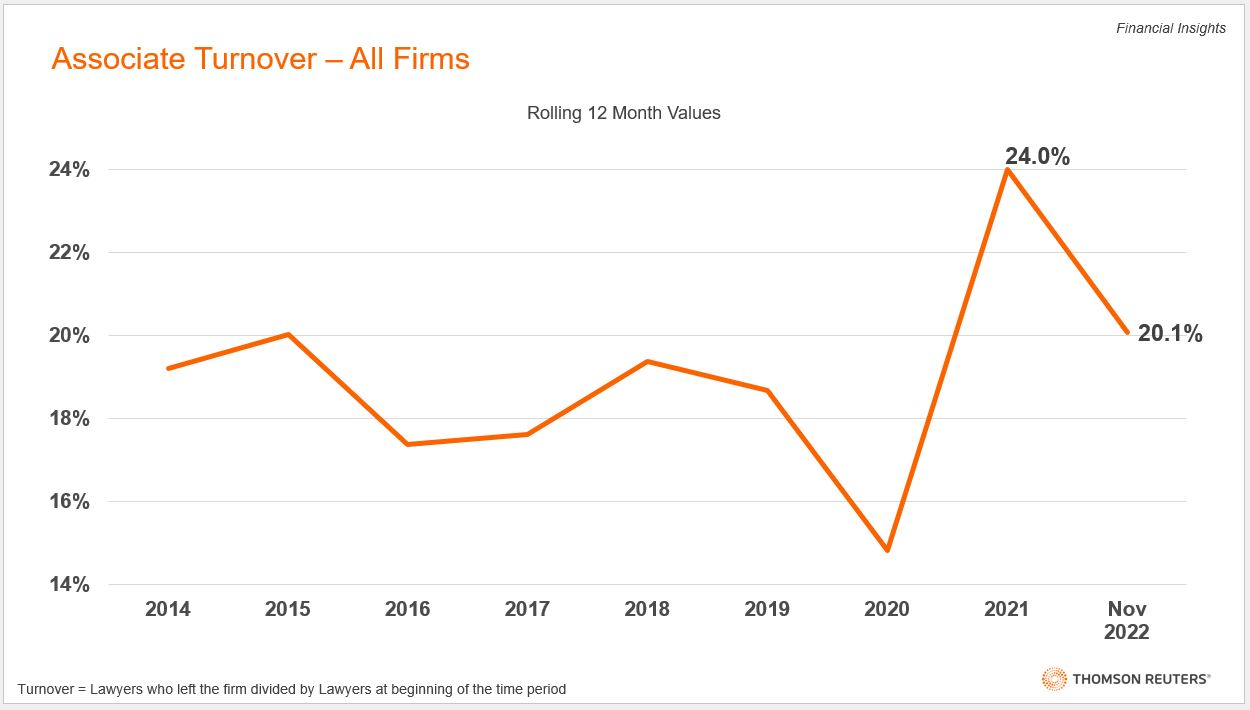

As law firms grappled with the need to reduce the high levels of turnover that many firms experience in 2021, raising the level of associate compensation was one clear weapon in firms’ arsenal. Since 2014, firms had never experienced associate turnover above 20.0%, but by the end of 2021 that figure had risen as high as 24.0%.

Looking at the chart above, we can see that, overall, there has been a notable decrease in turnover since that peak in 2021. Unfortunately, the results of 2022 were still poor compared with most years, and while retention improved, it may have been bolstered by factors outside of firms’ efforts in the area. For example, as the environment became more economically uncertain and legal demand for law firms decreased on average, many associates may not have had the leverage to make a move to a new firm.

What we want to know, specifically, is whether firms that made aggressive pushes in associate compensation growth saw significant improvements in turnover rates, and whether they outperformed more conservative firms.

To begin this analysis, we identified the segments of law firms in which we were interested:

-

-

- High-growth law firms — those in the top 25% of fastest associate compensation growth; and

- Low-growth law firms — those in the bottom 25% slowest associate compensation growth.

-

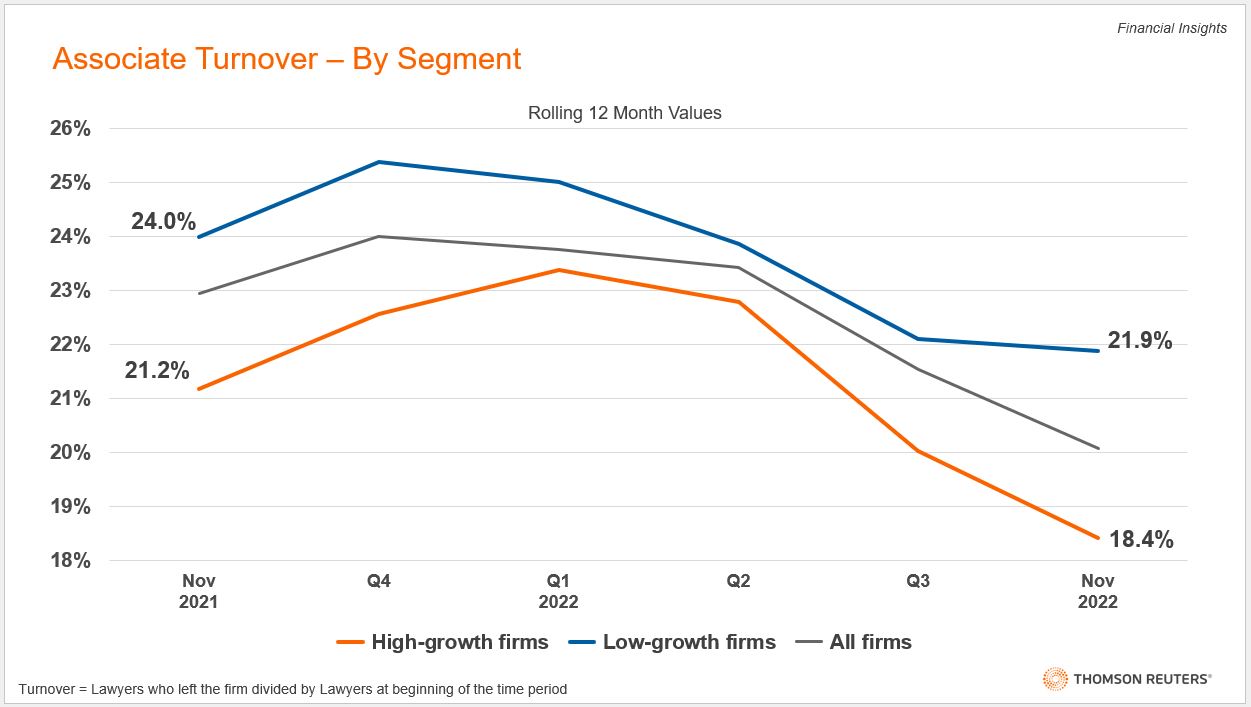

We found that the high-growth firms had a statistically significant improvement in turnover rates, down 2.8 percentage points to 18.4% turnover in November 2022, compared to an average of 21.2% turnover in November 2021. When we looked at the low-growth firms, although there was an improvement in turnover, we were unable to identify a level of significance great enough to discount the possibility that the results were a product of random chance.

More importantly, we observed that the percentage point gap between the high-growth and low-growth firms in turnover widened from a 2.8 percentage point difference in 2021 to a 3.5 percentage point advantage in 2022. Statistical tests revealed that high-growth firms’ average turnover was significantly better than low-growth firms’ average, which strongly suggests that the results seen in the high-growth firms are not merely a result of the industry’s overall improvements (a case of a low tide lowering all boats), but more likely the result of a concentrated effort.

As stated in last year’s 2022 Report on the State of the Legal Market — which analyzed law firm data from January 2021 to November 2021 — increased salaries are not the only reason why associates choose to stay at a firm. Broader market conditions, and other factors such as firm culture, future development prospects, and rewarding work are all pieces of the puzzle that contribute to a firm’s general stickiness. The results of this analysis, however, show that in 2022 pay was an especially vital piece of the puzzle.

While the high-growth firms’ retention in 2022 was strong relative to the rest of the industry, another key reason firms see compensation growth is because they need to increase headcount in order to meet growing demand. In 2021, firms scrambled to add associates to meet an explosion in demand growth; but in 2022 firms saw that demand growth slip away. Despite this, many firms opted to continue growing their associate ranks regardless of the reversal in demand, a strategy that has increasingly squeezed firm productivity and thus profits.

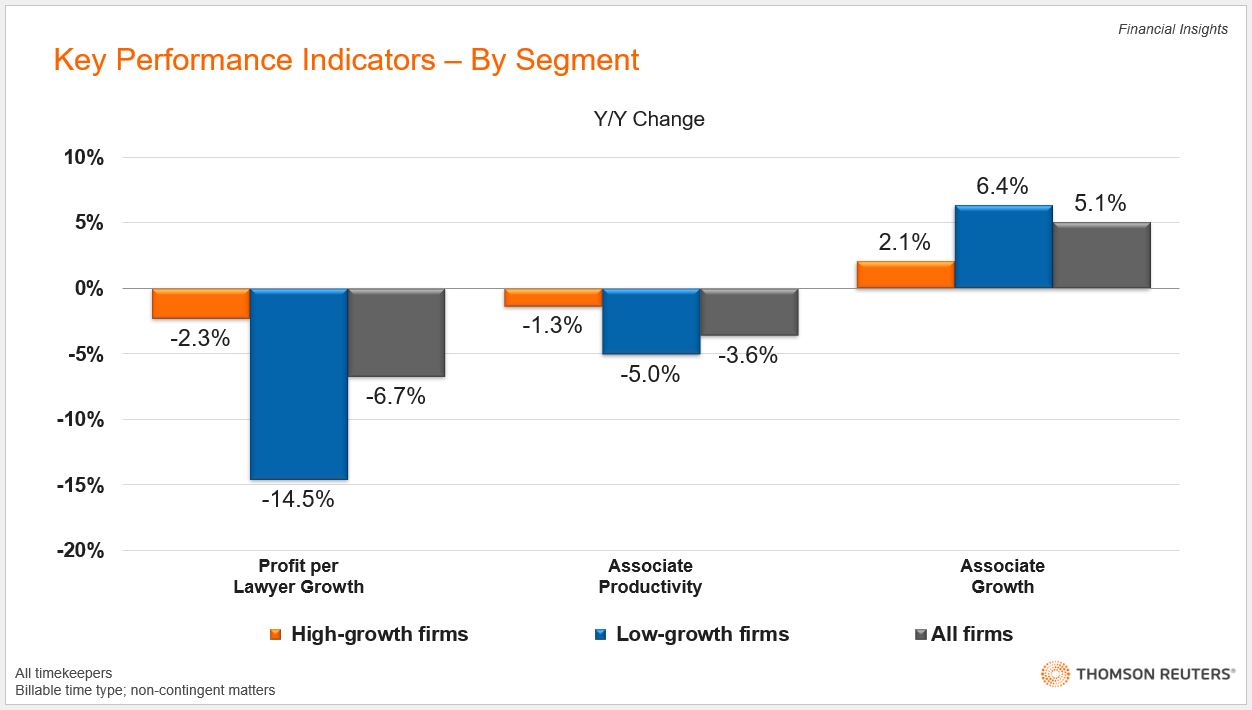

High-growth law firms, however, seems to have adjusted their associate growth strategy to current market conditions, as they only grew their associate ranks by 2.1% in 2022, far less than the average law firm. Low-growth firms, conversely, pushed for 6.4% associate growth, far greater than high-growth firms and the industry average. This could suggest that the firms which grew associate compensation the most grew compensation for associates they already had rather than simply expanding the ranks. If true, this could mean that high-growth firms appear to have rewarded the work done by their known associates, while low-growth firms may have focused on adding unknown and potentially untested new hires or mid-tier laterals.

Eventually, low-growth firms’ combination of higher associate headcount growth and minimal average demand growth (0.9%) tanked their average associate’s productivity by 5.0%, while high-growth firms saw productivity contract by only 1.3%. Additionally, the average high-growth firm’s productivity grew by 3.9% in 2021, so the slight contraction experienced in 2022 has not dropped high-growth firms below their pre-pandemic levels.

On an hour-per-lawyer basis, we saw that high-growth firms’ associates worked on average 122 more hours per year than associates in low-growth firms. This wouldn’t be particularly surprising if high-growth firms did, in fact, focus on retaining more experienced lawyers, while low-growth firms added fresh faces that are typically less productive while they are being trained in their first years.

Overall, it’s clear that high-growth firms managed the productivity of their associates far better than low-growth firms. At the end of the day, however, it’s firm’s bottom lines that are what matter most. Thus, the question, Did rapid increases in associate compensation hurt profitability? must be asked.

Well, relative to how the rest of the market performed, the resounding answer to that question is… No, rapid increases of associate compensation did not necessarily hurt profitability (or at least no more than did the overall souring environment in the legal market). On a profit per lawyer basis (PPL) the average firm saw declines of 6.7% in 2022, while low-growth firms saw steep declines of 14.5%. High-growth firms only saw a PPL contraction of 2.3%, a much easier decline to swallow.

Obviously PPL is a key metric, but law firms also need to think about the long-term goals of delivering the highest quality service to their clients, which is directly connected to the caliber of associates that firms hire and retain. In 2022, if it was truly high-growth firms’ strategy to retain their more experienced associates, that could pay long-term dividends. But even in the short term, we certainly saw high-growth firms reap the rewards of this strategy relative to low-growth firms and the rest of the overall market.