The average Australian law firm appears well positioned to continue performing well in this latest fiscal year, according to our latest market report

In the 2024 financial year (FY 2024), the Australian legal market has shown none of the shakiness that marked the beginning of the prior year. Rather, the average Australian law firm has enjoyed the kind of financial performance that would be the envy of many peer law firms around the world.

Further, businesses seem poised to increase their legal spend on outside counsel as inflation continues to cool on the Australian continent, creating possibilities for law firms in a wide variety of practice areas. All this points to a legal market that finds itself on more solid footing at the midway point of FY 2024, according to the new Australian Legal Market Midyear Update published by the Thomson Reuters® Institute.

The Australian legal market appears well positioned to continue its long string of success, having seemingly fully recovered from the doldrums of early FY2023 with no signs of looking back.

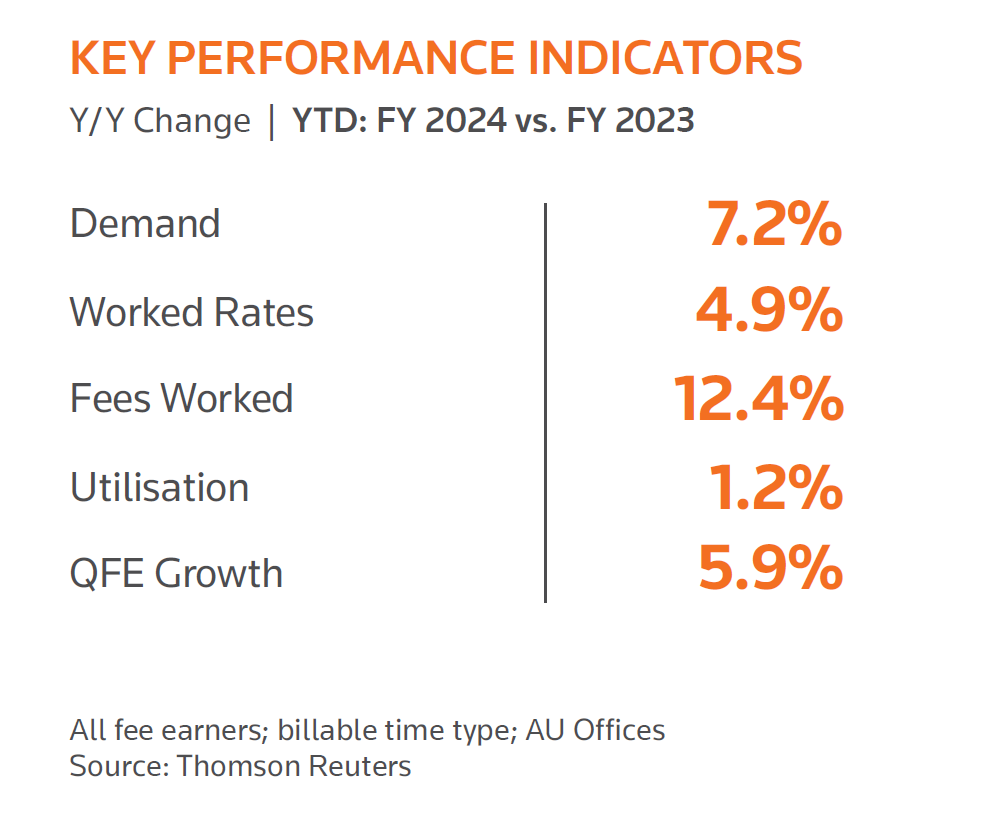

Indeed, Australian law firms’ key performance indicators show strengths across the board. For example, demand for legal services — a measure of total billable hours worked by the average law firm — grew by an impressive 7.2% in the first half of the year compared to the same point last year. That same metric at the midyear point of FY 2023, by comparison, showed legal demand for the average firm’s services contracting by 5.0%, meaning that this year’s performance shows a remarkable swing in fortunes and further represents a continuation of a trend that started in the latter half of the prior financial year.

Interestingly, this growth in demand was driven by nearly every practice area. Dispute resolution and general corporate work accounted for more than two-thirds of all hours worked at the average firm, and grew by 9.5% and 7.5%, respectively. Even the slowest growing practice area, mergers & acquisitions, still posted a healthy 2.4% growth. (As a point of global comparison, the fastest growing practice area in the US during 2023 was bankruptcy, which posted 4.4% growth for the year, according to the recently released 2024 Report on the State of the US Legal Market from the Thomson Reuters® Institute.)

Beside legal demand, other key performance metrics all were flashing positive signs for the Australian legal market, including strongly growth in fees worked, a measure of year-over-year growth in the product of worked hours multiplied by rates, which year-to-date in FY2024 grew an impressive 12.4%, compared to FY2023.

Future growth on the horizon

While leaders of Australia’s large law firms are likely quite proud of their achievements, and deservedly so, the question remains whether the market will continue to be favorable for Australian law firms.

Fortunately, some key indicators appear to point toward yes. In its Economic Survey of Australia, the intergovernmental Organisation for Economic Co-operation and Development (OECD) pointed out that while Australia’s economic growth may be slowing after a rapid post-pandemic recovery, its GDP growth is projected to settle around 2%, in line with the trend line before the pandemic and a signal of loftier times ahead, according to OECD numbers. The OECD also highlighted Australia’s slowing inflation, which while still high, has cooled quite a bit since its 2022 peak — another indication that Australia’s economy is returning to a more normal level.

Not surprisingly considering this landscape, corporate clients are expressing widespread optimism about their level of legal spend, indicating that spending on outside counsel will probably increase over the coming 12 months. This higher legal spend is anticipated across a wide swath of practice areas, including M&A, disputes, labor & employment, and regulatory work.

Given all this, the Australian legal market appears well positioned to continue its long string of success, having seemingly fully recovered from the doldrums of early FY2023 with no signs of looking back. And a strong finish to FY2024 will position Australian law firms well to make key investments in emerging artificial intelligence technologies which will, themselves, will likely usher in a new era for the legal industry in the very near future.

You can download the full “Australian Legal Market Midyear Update” here.