In a new blog series on the Midsize law firm segment, we'll analyze the performance of these firms and see what challenges and opportunities they may face in the future

There has already been quite a bit of commentary thus far this year regarding the performance of Midsize law firms — and understandably so, given the general strength of this segment for much of the past 18 months.

Historically, we have produced a report on the state of Midsize law firms in our traditional report format. This year, however, we opted to forego the formal report and instead produce a series of blog posts examining the same data, but in a format that will hopefully make some of the information easier to find and more manageable.

We begin that series as we would the larger report, with an examination of key performance indicators (KPIs) and what these metrics indicate about the overall health of the Midsize law firm economy.

Performance at a glance

Demand

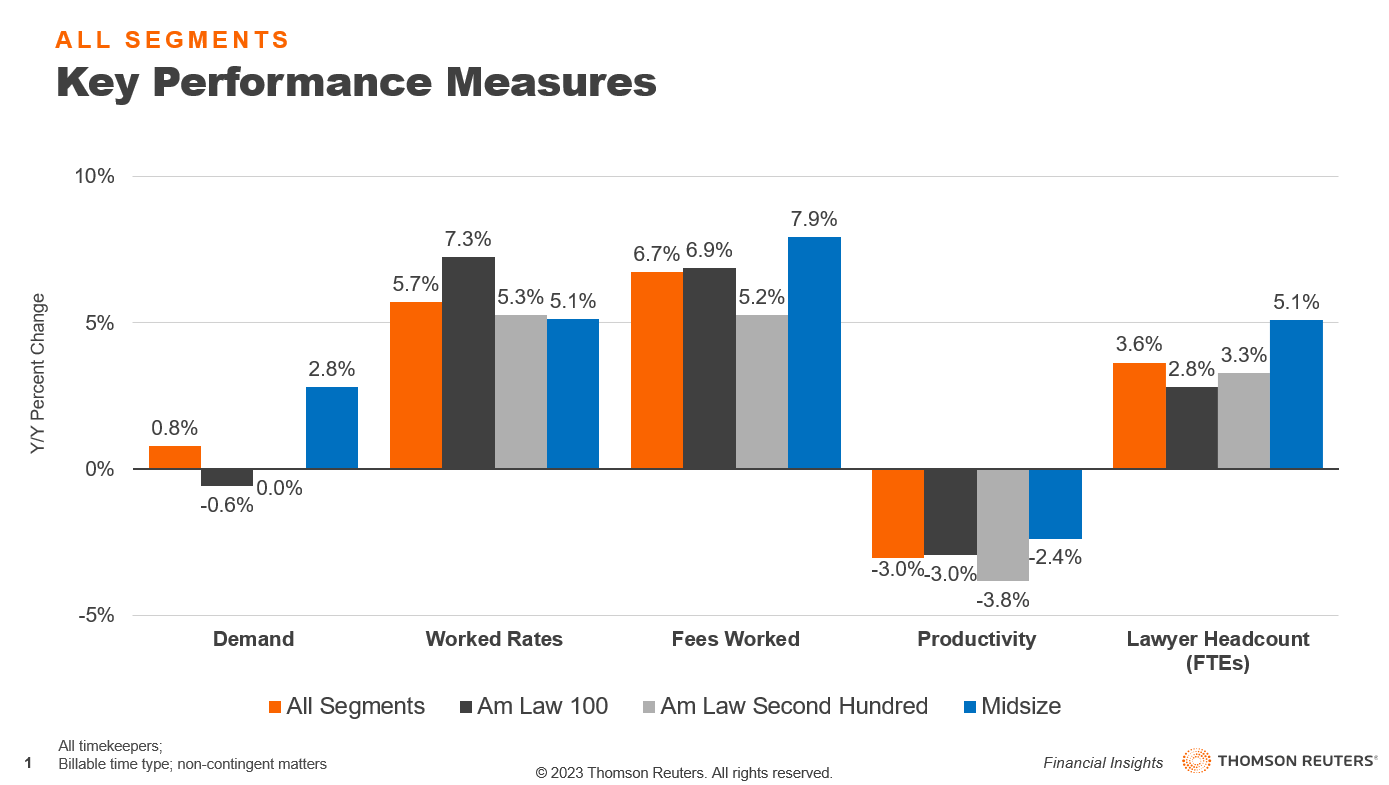

Even a brief look at market-wide KPIs provides a clear demonstration that nearly all of the growth in demand experienced by law firms this year has been to the benefit of Midsize law firms. The average law firm saw growth in their total billable hours — the metric we use to measure demand — of 0.8% in the first half of 2023. When we break down the analysis by law firm segment, however, we see an immediate disparity.

The average Am Law 100 law firm saw their demand contract by 0.6% while the average Am Law Second Hundred law firm posted flat demand compared to a year ago. At the same time, the average Midsize law firm posted strong demand growth of 2.8%. This continues a trend seen for several successive quarters now that shows Midsize law firms leading the market in demand growth.

This trend is notable not only for its length, but for its rarity.

Prior to the current streak, the last time Midsize law firms led the market in demand growth was the end of 2015. In 2016, a confluence of concerning factors — including a U.S. presidential election and the advent of Brexit — saw demand quickly shift toward Am Law 100 firms, with those firms experiencing the bulk of demand growth through 2021.

During that same period, Midsize law firms routinely found themselves in third place among three segments for demand growth. The relatively recent shift in fortunes has led to other positive benefits for Midsize law firms so far this year.

Revenue and rates

Fees worked is a metric we rarely discuss in depth, but it is worth a closer look given the strength of this metric for Midsize law firms. Fees worked is a metric meant to track revenue potential and is calculated by making a year-over-year comparison of the product of demand hours multiplied by worked rates (sometimes called agreed upon rates.)

For both Am Law segments, it’s clear that all growth in fees worked for the year is attributed to growth in worked rates. However, Midsize law firms are enjoying the double benefit of growth in demand multiplied by quite strong growth in worked rates.

Even with this being the case, it is worth exploring Midsize rate growth a bit more closely.

The average Midsize law firm posted 5.1% growth in worked rates, leaving them in third place among the three tracked segments. The strength of this pace of rate growth, however, is a function of the comparison being made. When compared to the historically high 7.3% worked rate growth for Am Law 100 firms, 5.1% appears somewhat meager. Yet, Midsize rate growth compares very favorably to Am Law Second Hundred firm as well as to historic Midsize rate growth performance.

Even a brief look at market-wide KPIs provides a clear demonstration that nearly all of the growth in demand experienced by law firms this year has been to the benefit of Midsize law firms.

Indeed, a mere six months ago, Midsize law firms posted 2022 worked-rate growth of 3.8%. The acceleration of rate growth to nearly match Am Law Second Hundred firms is a likely reflection of Midsize law firms feeling increasingly comfortable in their position within the legal market and flexing some of their newfound competitive power.

Increasingly aggressive rate growth does appear to be paying dividends for Midsize law firms in terms of their fees worked. However, as we will examine more closely in subsequent installments in this series, there are other potentially concerning factors of which Midsize law firms should be mindful that are related to potential declines in realization against those increasingly strong rates.

Lawyer headcount and productivity

Midsize law firms posted an aggressive lead in lawyer headcount growth through the midpoint of 2023. The average Midsize law firm currently has 5.1% more lawyers than at this same point a year ago. As we will explore in greater depth in a subsequent addition to this series, the consistently higher costs of attorney talent means that lawyer growth is placing a strain on Midsize law firm expenses.

However, the more immediately noticeable effect of this increase in headcount comes in its impact on lawyer productivity.

Strong demand growth for Midsize law firms was not enough to pull productivity into positive territory. The combined effects of market-leading demand growth and headcount growth resulted in the smallest productivity contraction of any segment. However, even the smallest contraction remains a contraction.

Given the strength of Midsize demand growth, there are opportunities to move productivity into positive territory. However, that would require a cooling of headcount growth to create more balance with demand. Midsize law firms have seemed consistently set on growing their headcount throughout the course of this year. The reason for this likely varies by firm, but some may be taking advantage of experienced talent being shed by Am Law 100 law firms, while others are likely still pursuing a longer-term strategy to improve leverage, traditionally a difficulty for many Midsize law firms.

Each of these themes bears more scrutiny and will be explored more deeply as this series on the current state of Midsize law firms continues in the coming weeks.