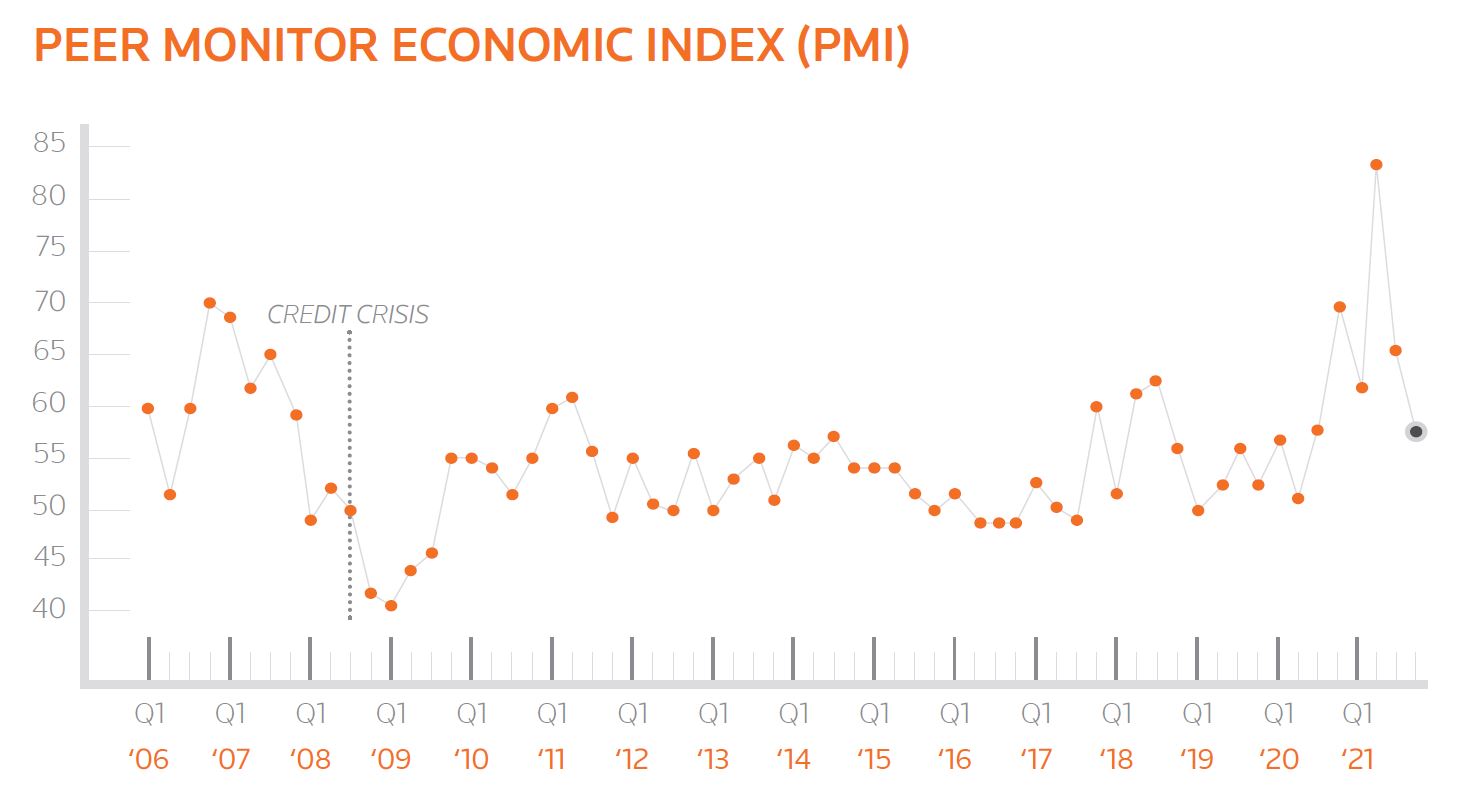

The Thomson Reuters Peer Monitor Index (PMI) has continued to fall as expenses surge, but it remains in the top echelon of scores

The final quarter of 2021 saw two forces collide: a booming legal practice in corporate transactional matters running up against a surge in law firm expenses, mostly related to compensation. Without the beneficial low baselines of 2020 to power the index into the stratosphere as happened in 2021’s second and third quarters, the fourth quarter had to be scored on its own merits against a strong Q4 2020. Ultimately, the outcome was a 9 point drop in the Thomson Reuters Peer Monitor Index (PMI) to 58, a score, that while falling for the second consecutive quarter to reflect the lowest score in five quarters, still remains in the top quartile of the PMI’s scores, historically.

The PMI, produced by Thomson Reuters, is a composite index of law firm market performance that represents the quarter-over-quarter change in drivers of law firm profitability, including rates, demand, productivity, and expenses. Positive factors driving firm profitability will produce a higher score.

When breaking the PMI down to its key factors, the good news is readily apparent. Demand was up 4.2% in Q4, and unlike previous quarters, this growth is mostly organic. When measured against the “normal” year of 2019, this quarter had the fastest demand growth since the Great Financial Crisis. Further, much of this growth is on the back of transactional practices. The fastest growing legal practices in Q4 were transactional practices — real estate, corporate (general), M&A, and tax. With billing rates holding at 3.6% in anticipation of 2022’s rate increases, the industry is by no means experiencing a shortage of business.

You can download the full Q4 2021 Peer Monitor Index Report below

On the flip side, serving as demand’s nearly equal but opposite force, was expenses. Overhead expenses increased 5.8% on a rolling 12-month average as they began to push back from their pandemic lows. The source of this growth was primarily technology, office, and marketing & business development costs — much of which had sat dormant during the pandemic. As most firms have yet to implement return-to-office programs, this category is expected to only grow.

More pressing is the matter of direct expenses, which were up 8.4% on a rolling 12-month average. Some of this growth is natural, as firms grew their lawyer FTE headcount by an average of 3.8%. Under normal circumstances, direct expense growth would be expected to parallel FTE growth as increased attorney compensation and benefits are an anticipated and necessary cost to meet client demand for hours. The industry’s ongoing talent war, however, has resulted in per-FTE costs climbing, resulting in this surge of direct expenses beyond what could be contributed to natural lawyer growth.

Results in Q4 were simultaneously bolstering and worrying. The quarter was always destined to produce a score lower than the previous quarters, because Q4 2020 was when the market began its rebound, thus depriving Q4 2021 of a low-baseline advantage. The fact that the PMI for the quarter is still within the top echelon of historic scores is a solid sign of strength for the large law firm industry. The growing expenses, however, should give everyone pause.

Demand may come and go, but additional expenses like associate salaries tend to stick around.