What can tax & accounting firms do to keep their younger accounting professionals highly satisfied with their jobs and avoid the headaches and cost that heavy attrition can bring?

The term quiet quitting has replaced the Great Resignation as the in-vogue term in the second half of 2022 to describe worker attitudes and actions in the post-pandemic world. Indeed, the term has been consuming the majority of media discussions of trends in work, particularly among younger workers.

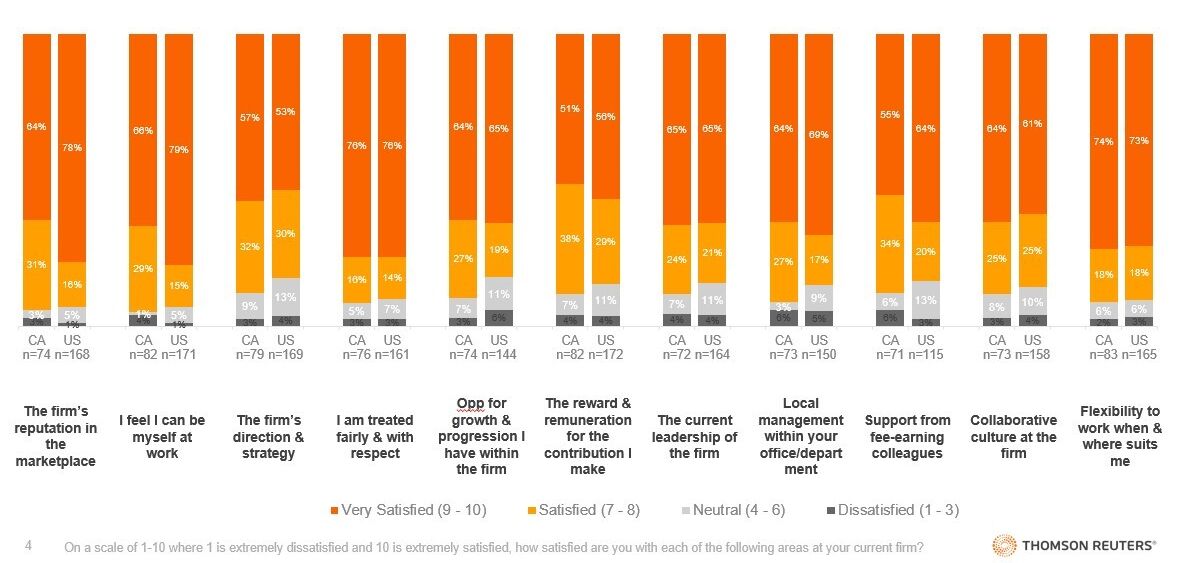

Yet, despite all of the relatively negative workplace trends covered, the results from a Thomson Reuters Institute pulse survey taken in August didn’t uncover the depth of negativity among younger workers employed at tax & accounting firms the media would have you believe. In fact, more than half of all young workers surveyed in the US and Canada reported that they are highly satisfied across a number of workplace factors, including: i) individual factors such as a feeling that I can be myself at work, opportunities for growth and career progression, flexibility, and a feeling that I am treated fairly and with respect; and ii) firmwide factors such as their firm’s collaborative culture, current leadership, and direction and strategy.

Firm Satisfaction

Diving deeper into the data, you can see some differences in the top satisfaction factors between the US and Canada. In the US, for example, the top drivers of high satisfaction were a mixture of individual and firm factors, with individual factors sitting in the first and third spots. A large majority of respondents (79%) said they were very satisfied with the feeling that I can be myself at work; and 76% were very satisfied with the idea that I am treated fairly and with respect — and 78% said they were very satisfied with their firm’s reputation.In Canada, on the other hand, the top drivers of high satisfaction were solely individual factors — I am treated fairly and with respect was cited by 76% of respondents and flexibility was cited by 74%.

More consistency existed in the areas that were less satisfactory across the US and Canada with just over half of respondents saying they were highly satisfied with reward and remuneration and the firm’s strategic direction.

When respondents were asked in an open-ended question about what they like most, colleagues and clients were at the top of the list, with 40% of US respondent saying that and 30% of Canadian respondents. Not surprisingly, the second most popular factor that young accountants liked about their accounting firms was flexibility in the US, and the autonomy and the type of challenging work in Canada.

Drivers of flight risk

Flight risk among young accountants was significantly lower than their peers in the legal profession. The flight risk of accountants is about 25% to 28%, while the average flight risk for law firm associates is about 46%.

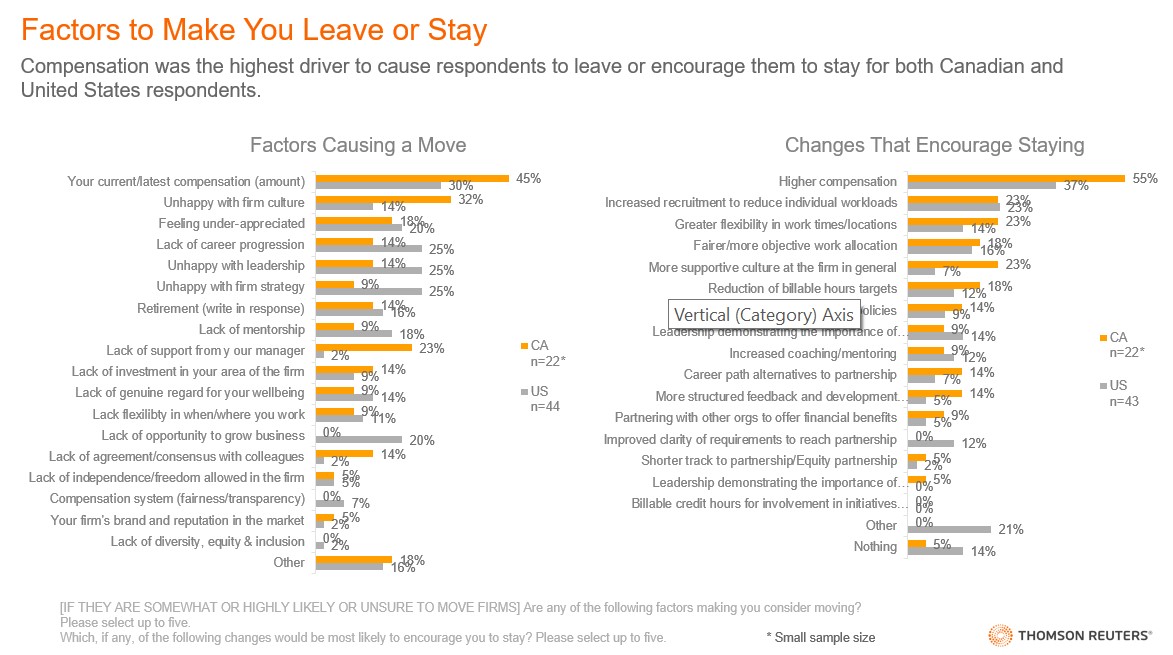

Interestingly, while drivers causing employees to move in the US and Canada are somewhat consistent across broader, cross-industry employment trends, it did vary for those young employees at accounting firms in the US and Canada. For example, compensation, lack of career progression, and unhappiness with firm leadership and firm strategy topped the list of reasons to leave your current firm for young employees in accounting firms in the US. And compensation, unhappiness with culture, and a lack of support from managers were the key reasons to leave among young accountants in Canada.

Recommended actions for employers

Of course the challenge for accounting firms in both the US and Canada, especially those that want to retain the next generation of accounting professionals is finding ways to turn these insights gleaned from the survey into positive action, such as:

Double down on strengths — Being treated fairly and respectfully was a top area of high satisfaction for accountants in both the US and Canada. Fair treatment is a strong indicator of employee retention and is a disincentive to for young workers to leave their current employer. Indeed, it has been widely reported that among younger employees the thought of “being treated fairly and with respect was even more important than their income.”

Further, young accountants see authenticity at work as a strength for tax & accounting firms, and again, this is a strong factor in employee retention. Indeed, more authentic workplaces produce better retention and more productive employees, according to the Society for Human Resource Management.

Young accountants see authenticity at work as a strength for tax & accounting firms, and again, this is a strong factor in employee retention.

Finally, Canadian accountants valued their flexibility and saw it as a strength of their employer. Therefore, continuing to promote flexibility in terms of where, when, and how work gets done will encourage longer tenure by young employees at tax & accounting firms.

Increase the effectiveness of firm leaders and managers — If there were any actions for tax & accounting firms to address based on the fact that 25% of young accountants remain a flight risk, it would be to focus on ways to increase satisfaction with firm strategy, as well as with firm leadership and management.

Communicating and articulating the firm’s strategy from the top of the organization down to first-line managers on a consistent basis so that each individual can see how their role contributes to the overall strategy is vital to this process. In this way, employees — especially younger or new employees — can learn and understand the firm’s strategy while seeing how firm leadership and managers are conveying it. “Managers need to create accountability for individual performance, team collaboration, and customer value,” according to management consulting firm Gallup. “And employees must see how their work contributes to the organization’s larger purpose.”

Likewise, improving manager effectiveness by training managers to hold conversations about their life situation, strengths, and goals is a key mechanism for improving the employee experience and engagement, and avoiding burnout. The “best requirement and habit to develop for successful managers is having one meaningful conversation per week with each team member — 15 to 30 minutes,” according to Gallup.

These investments of time and energy will help tax & accounting firms to boost their retention of young workers. At the current cost of six figures in turn-over costs for most entry-level accounting roles, multiplied by the level of flight risk, managers who spend 15 minutes or more of one-one-one time with each employee seems like a worthy investment, relative to the cost of attrition.