Competition in the United Kingdom’s legal market is heating up, mainly due to law firms in the United States that turned their attention towards the UK more than a decade ago

The strength of UK legacy leaders among the Magic and Silver Circle law firms means that any incursion into the UK legal market was always going to be a difficult task. As certain milestones are hit, however, an increasing level of attention is being paid to what US firms are doing.

Our recent research into the UK’s competitive legal landscape compared UK clients’ usage and perceptions of Magic and Silver Circle law firms with their perceptions of those US-based firms that have built out a strong presence in the country. We also look at how US-based firms are demonstrating strategies of scalability and differentiation in order to carve out a strong position in the UK legal market.

A sector focus

Entering a market is never as simple as putting boots on the ground and waiting for clients to call. US-based law firms have come from strong vantage points in their home territory and have been able to leverage that to get their feet in the door in the UK. One tactic that appears to be emerging is US firms being able to identify with which clients a successful relationships could be built.

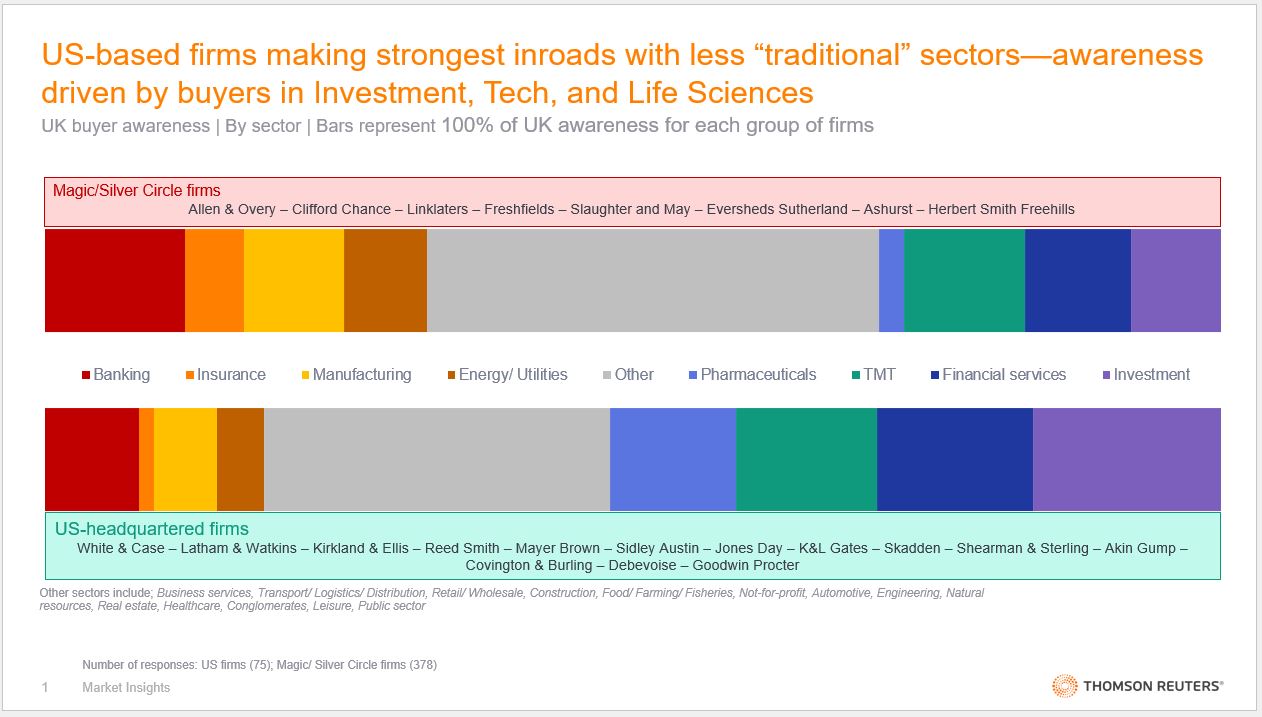

The chart below shows a sector breakdown of the UK clients that think of Magic and Silver Circle firms in a top-of-mind manner, compared to those that think of US-based firms in that way. The disparities are clear: UK clients in more traditional, well-established sectors — such as banking, manufacturing, and energy — drive a bigger proportion of awareness for Magic and Silver Circle firms. Meanwhile, UK clients in heavily evolving sectors such as pharmaceuticals and investment represent a much larger share of US firms’ UK awareness. These sectors typically have interests in both the UK and the US and make up similar proportions of client awareness in both jurisdictions. As a result, it makes sense for firms with experience in these practice areas and industries to strategically target such clients when developing their client base.

Scaling up

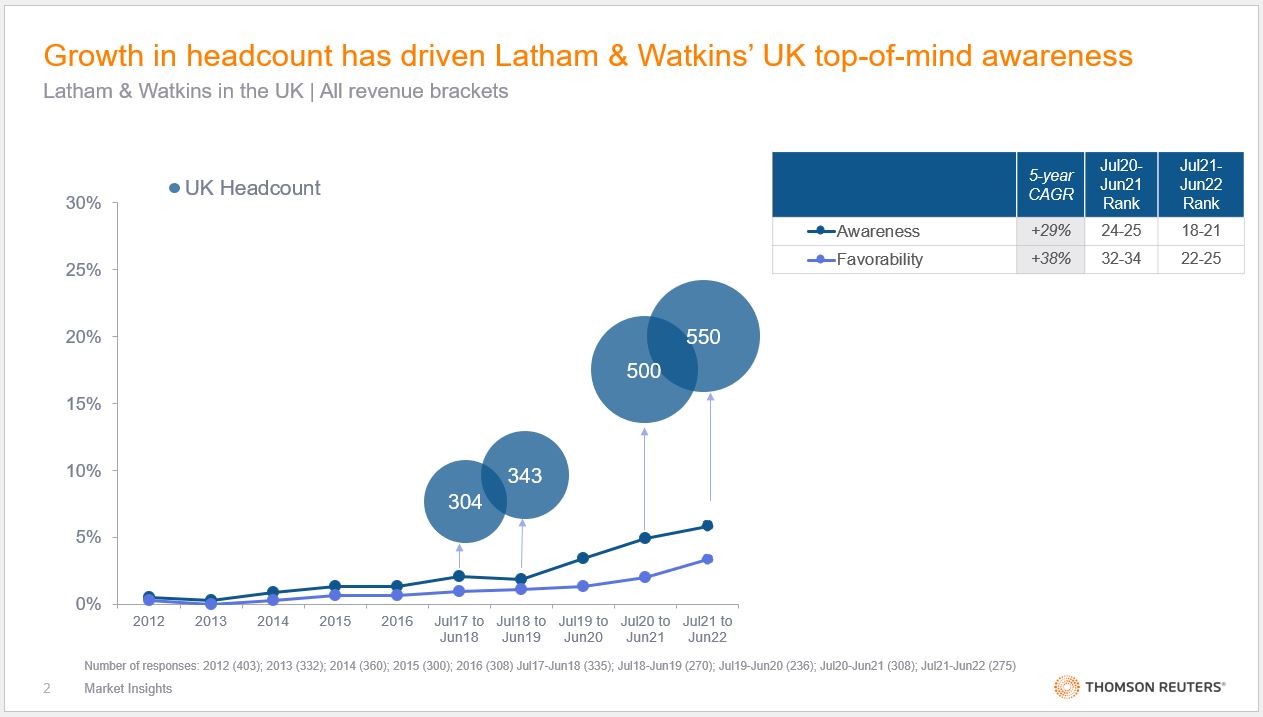

Further, the ability of US firms to attract UK lawyers has caused some concern among UK-based firms. The most practical — and effective — way to increase top-of-mind awareness in a legal market is through lawyer outreach; therefore, the bigger the firm’s headcount, the more likely these firms are to be sitting top of mind for UK clients.

For example, Latham & Watkins has successfully employed this strategy to make strong headway into the market and has driven a high rate of growth in both its awareness and favorability in the UK over the past 10 years.

Indeed, a look into the strategies used by Latham & Watkins and Kirkland & Ellis show how the investments these firms have made in UK lawyer headcount have helped them carve out an increasing rate of top-of-mind awareness among UK legal market clients.

Differentiating in a globalized market

Yet, size is only one strategy law firms can use to grab a larger share of the market. Specialization around a particular segment of the market is another effective approach, whether it’s being known as the best in a particular sector, region, or work type. It’s also this strategy that has driven Kirkland & Ellis’ position in the minds of UK-based clients.

Kirkland & Ellis may not be the law firm that UK-based clients think of first in a general setting; however, that changes when you ask these same clients which firm they would consider for their top-level or cross-border deals. Kirkland & Ellis is the only firm that UK clients name more frequently for deal consideration than for general awareness. (Note: Only firms with five or more counts for top-of-mind awareness were considered in this measure.)

The fact that Kirkland converts awareness into consideration for M&A work more than other firms in the UK market is indicative of the threat they pose to incumbent Magic and Silver Circle firms. In the case of Kirkland & Ellis, size isn’t driving their market share growth, rather it is client consideration that’s coming from the firm’s reputation for success in M&A work which is hard to challenge. Latham & Watkins has followed a similar strategy, focusing on building its brand position with high-priority banking & finance work, demonstrating a strong go-to-market strategy around these practices within the UK market.

Favorability

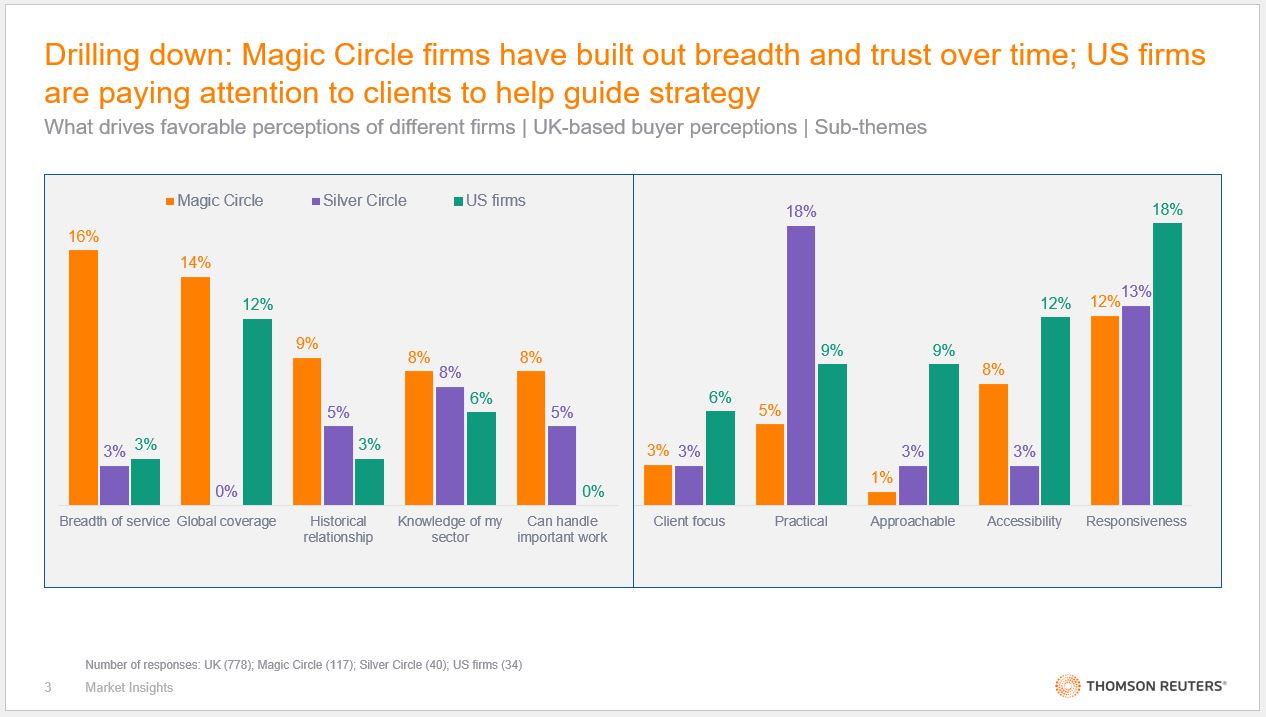

We have discussed the what, in terms of work types, that US firms are using to build their brand position within the UK market. To understand the why, however, we need to look further into what clients say is driving their favorability for a particular law firm. For example, UK clients that favor Magic Circle firms are much more likely to favor them for their specialization and breadth of service — in fact, approximately one-in-six clients say they appreciate the firms for their range of service offerings.

However, building a firm’s reputation as an expert takes time and resources — both of which Magic Circle firms have been able to put in place over many years. By growing to understand the needs of the market, these legal powerhouses have been able to build out the breadth of their services and become specialists in particular areas, which is reflected in what clients say they favor about these firms.

However, US-based firms are favored by UK clients for an entirely different skill set, indicating these firms are filling a unique hole that was existing within this market.

US firms see larger proportions of their favorability being driven by their client focus, accessibility, and approachability. Clients are being made to feel like they are being listened to by these firms, and that these firms are demonstrating their ability to be agile in their responsiveness. This is a great way to leverage better interactions with clients and gather information for business-generating conversations. Keeping their ear to the floor and listening to clients’ demands is key for an effective growth strategy.

Indeed, in the past 12 months through June 2022, 50% of UK clients said that they had adjusted their law firm rosters in the past 12 months, a sign of how quickly neglected client relationships can be lost.

Conclusion

As US firms scale up the size of their UK operations, focusing on offering high-value services to clients operating in growing sectors, building reputations as trusted advisors through client-centric relationships, and moving further into the thoughts of UK clients, Magic and Silver Circle firms shouldn’t panic… yet.

They still possess the lion’s share of consideration for work types and measures of awareness and favorability in the UK; however, they must be aware of the strategies being utilized by US firms that could result in Magic and Silver Circle firms eventually losing out on business.

You can learn more about transforming the quality of your strategic decisions with financial performance metrics and global market research insights, here.