Is historically low productivity a major manifestation of law firms' stumbling financial performance at the end of last year?

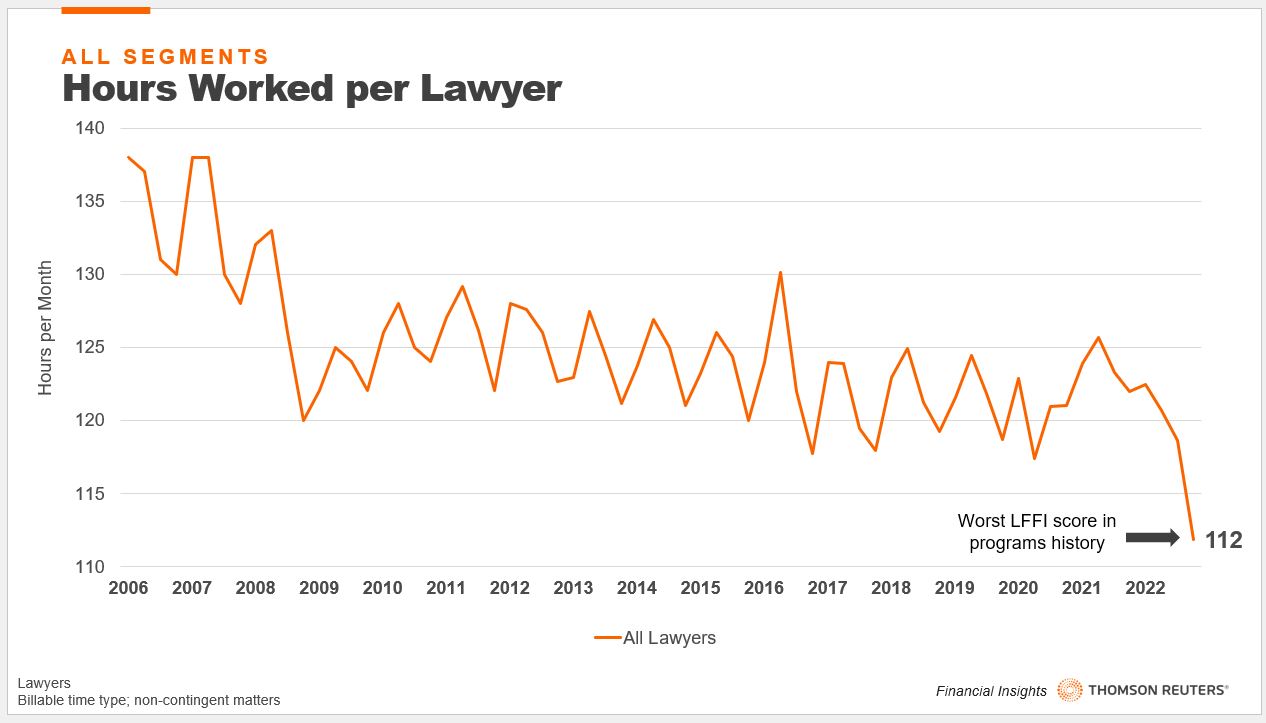

As we saw with last week’s release of the Thomson Reuters Law Firm Financial Index (LFFI), the LFFI recorded its worst score in the index’s history. Indeed, the fourth quarter of 2022 continued a six quarter slide which started from its highest score of all time, recorded in the second quarter of 2021, and has now set multiple, new all-time lows.

Even if generously viewed, this represents a reversal of fortunes for the legal industry that can only be regarded as remarkably stunning. And while significant challenges and obstacles have hampered many law firms in 2022, what does this score point to as a primary reason for this downturn?

Market observers might be wise to look at law firms’ exceptionally poor performance in productivity — a metric that is included in the LFFI score calculation — which contracted 7.2% in Q4. This decline in productivity was a result of firms’ continued efforts to expand attorney ranks, growing their full-time equivalent (FTEs) 3.6% in Q4. Firms pursued this full-employment strategy even amid the strong contraction in overall legal demand, which itself fell 3.9% in Q4. This heady mix of more attorneys with less work to do only has one clear result — plummeting productivity.

When this productivity question is looked at from a billable hours perspective, we can see that, after a steady downward trend over the past 15 years — one which has greatly accelerated since early 2021 — lawyers billed the fewest hours, 112 hours per month per lawyer, at the end last year since at least 2006.

One key reason for this all-time low billed-hour total, as we discussed in the 2023 Report on the State of the Legal Market, was the substantial drop in demand in transactional practices (a mix of corporate general, mergers & acquisitions, tax, and real estate practices), which had fallen off steadily over the latter part of last year after being a key demand driver throughout 2021 and the early part of 2022.

Who is being less productive?

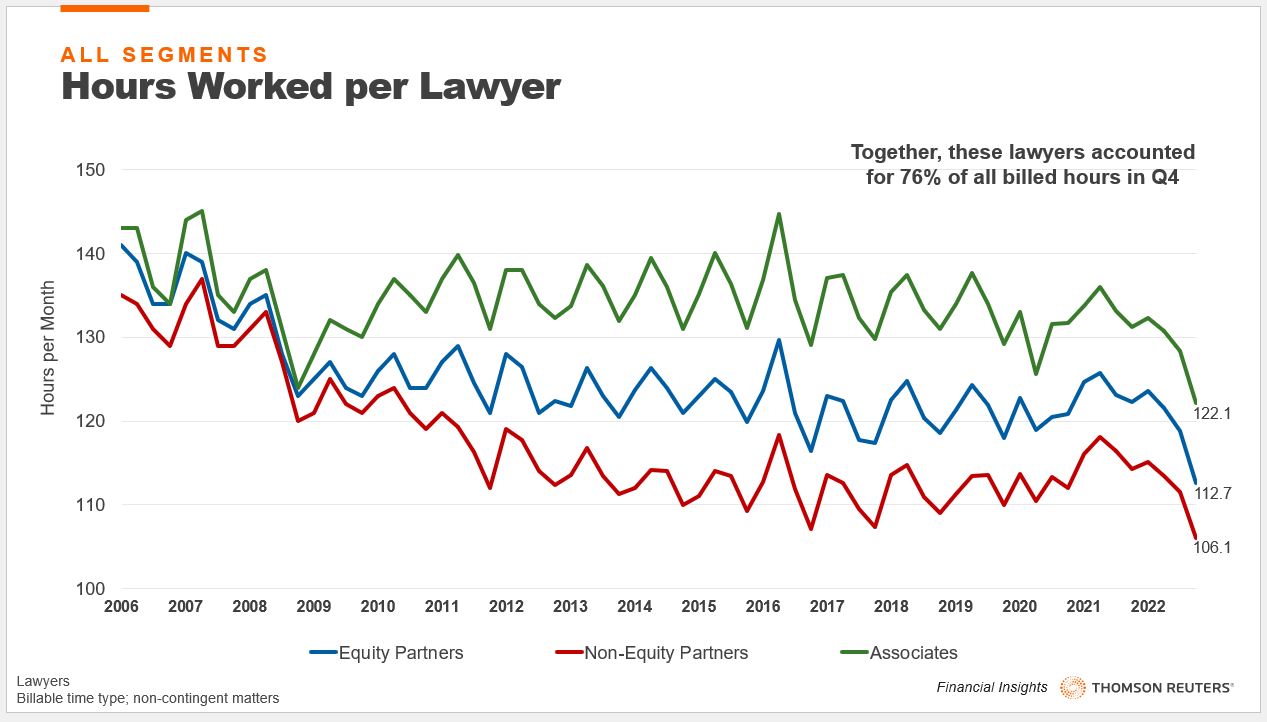

The drop in productivity seemed to be experienced across the largest types of attorney titles with Q4 seeing the worst billed hours per month recorded for associates, non-equity partners, and equity partners since at least 2006. These attorneys accounted for 76% of all billed hours in Q4, but even less impactful lawyer titles, such as of counsel and other lawyers (which are not represented on the graphic below), recorded their worst billed hours per month since at least 2006 as well.

As the above graphic shows, this past quarter caps off a four-quarter slide for these three lawyer titles and one that places an exclamation point of sorts at the end of a very bad year for productivity.

There are some mitigating factors, of course. For example, there is a seasonal aspect to hours-billed per month in which typically, lawyers bill the fewest hours in the final quarter of the year. In Q4 2022, however, we saw a stiff 6-hour drop recorded for all lawyers, which was the largest drop between the third and fourth quarters ever recorded. Even by individual title, the numbers were bracing: a 6-hour drop-off for equity partners in Q4 was the largest fall between the third and fourth quarters ever; and the 5.5-hour and 6.2-hour drops for non-equity partners and associates, respectively, were the biggest drops between the third and fourth quarters since Q4 of 2008, amid the Global Financial Crisis.

Practice areas of impact

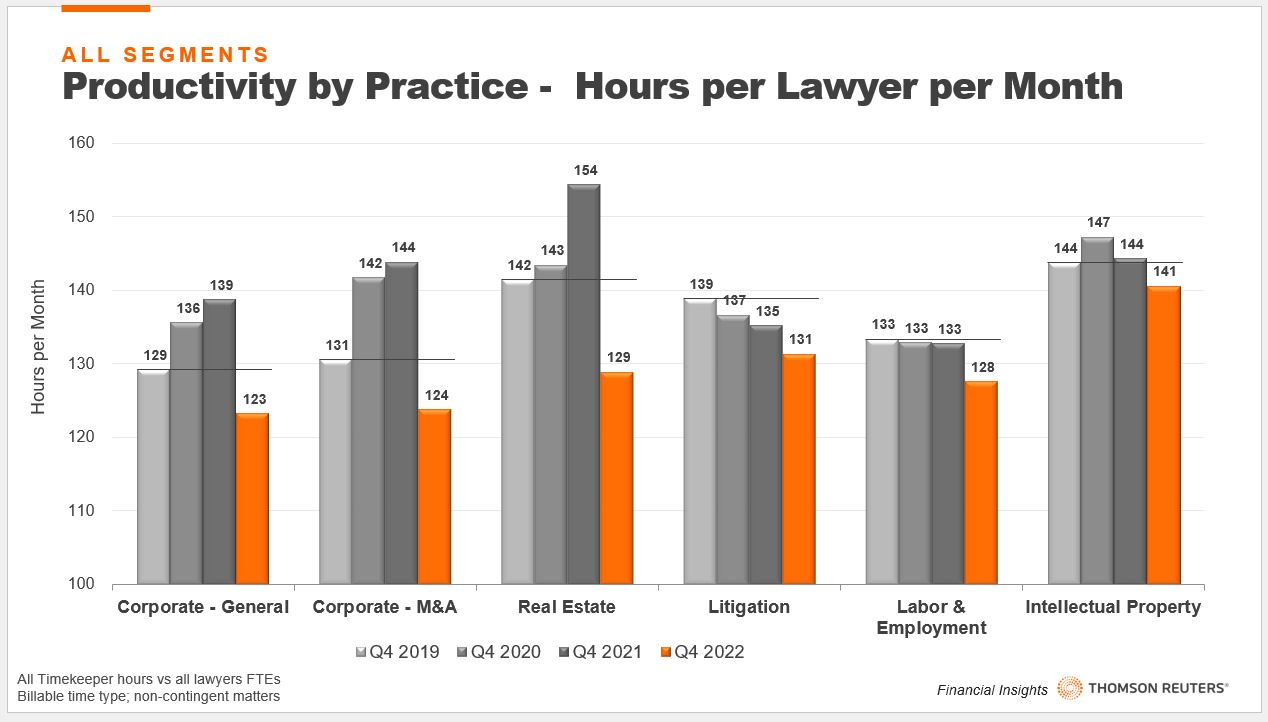

In addition to the variations of lawyer title of lawyer, we also can see which particular practice areas had the largest impact on the drop in year-over-year productivity.

As mentioned earlier, transactional practices experienced the greatest declines in hours per month per lawyer logged, with corporate-general and corporate-M&A each experiencing steep falls in hours billed in Q4 2022 compared with Q4 of the previous year.

Beyond that, every single practice area saw lawyers bill less hours in Q4 2022 than in pre-pandemic times, less than 2020, and considerably less than the same quarter in the year previous.

On an interesting side note, the chart also shows that the only practice area that has consistently declined in productivity over the last few years is litigation, which currently makes up 27% of all legal demand. However, it may be that litigation’s downward stair-step trend in productivity is the result of law firms continuing to add litigation attorneys while i) the nation’s courts are backlogged; ii) lower-value litigation work is being handled by alternative legal services providers; and iii) corporate law departments are taking on more of their own litigation work.

The focus on the performance in transactional practices is not misplaced, which is why its current trendline is so worrisome. However, as the LFFI report mentioned, if inflation continues to moderate and interest rates stabilize, transactional work may well recover. And if this recovery happens, it will certainly play in role in returning law firms’ productivity growth onto a more solid, positive footing.