The boom of e-commerce has benefitted retailers and restaurants, but may be giving their tax & accounting teams some major headaches

The rise of e-commerce has transformed the way many retailers and restaurants generate revenue. No longer tethered to in-store sales, they’ve embraced a whole new generation of online sales, virtual payments, and order-delivery platforms.

You would think that these new revenue-generating sources would create opportunities for Client Accounting Services (CAS) professionals within tax & accounting firms to provide more value-added consulting services to these retail clients.

Unfortunately, this isn’t the case.

Only 34% of junior-level accounting professionals feel “highly confident” in their ability to provide strategic business advice, according to a recent Thomson Reuters survey. Indeed, one of the major contributing factors to this “confidence deficit” is that these professionals spend so much time completing routine bookkeeping tasks that they have little bandwidth left over to devote to more strategic pursuits, the report noted.

Yet, why are these activities consuming so much of these professionals’ time? Some new research by Bookkeep and Paradoxes may offer answers — and potential solutions. A 2022 study sought to gain a deeper understanding of how e-commerce platforms are dramatically increasing the volume of manual data-entry activities CAS teams perform for their clients, and how these activities are affecting accounting firms’ bottom line. The findings indicate that accounting professionals will continue to be challenged if they stick to status quo manual processing rather than implementing new technologies.

The consequences of widespread e-commerce adoption

E-commerce now accounts for, on average, 19% of total sales among retailers and restaurants.

The pandemic accelerated the adoption of e-commerce, as brick & mortar stores and eateries began partnering with sales platforms like Shopify and Amazon, home-delivery services like Grubhub, Doordash, and Uber Eats to offer home-bound customers a way of accessing retail and restaurant services. This development also allowed a wide-range of online payment vendors to stay afloat when in-store sales plummeted.

As the use of e-commerce systems has increased, tax & accounting firms have had to rapidly scale up the scope of their revenue-recognition capabilities. According to the new study, accounting firms serving retail businesses now provide bookkeeping services for, on average, 1,592 clients, while managing 14,323 e-commerce transactions and 700 to 800 journal entries each month.

While partners in accounting firms welcome this business, the work itself is often a logistical nightmare for the CAS teams that handle these bookkeeping activities. Why? Because many retailers use several different e-commerce service providers, forcing CAS teams to log on to several different systems in order to gather activity reports for each revenue source.

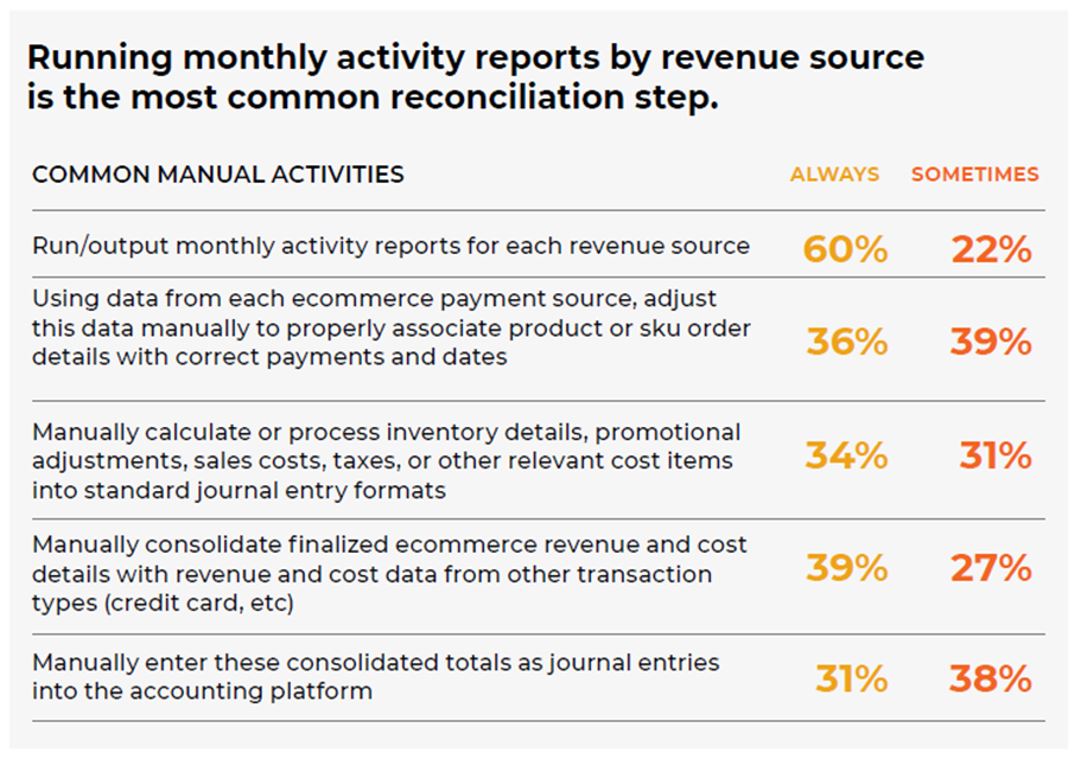

And because most e-commerce providers use their own proprietary and often error-prone data reporting conventions, many CAS teams have to spend an inordinate amount of time manually reconciling and entering this information into standard journal-entry formats before it can be entered into firms’ own accounting systems.

How much time do these activities take up? A lot. The research shows each CAS team member spends on average, 38 hours a month performing these tasks — roughly one-quarter of their monthly work time. Not surprisingly, the costs to accounting firms for this work is not insignificant, and they spend on average, $8,900 per month on these manual data-entry chores.

Further, the labor-intensive nature of these activities has led to attrition among many CAS team members, which has created a significant challenge for accounting firms that can’t easily find replacements.

For these and other reasons, many tax & accounting firms no longer do this work in-house. The study found that nearly one-half of accounting firms surveyed outsource these bookkeeping activities, costing them on average, $21,700 per month.

The solution? Automation

Tax & accounting firms shouldn’t count on e-commerce service providers to solve these problems for them. Providers are mostly focused on landing new customers, rather than making life easier for their customers’ accountants.

So, accounting firms have to find a solution for themselves, and one way many are doing so is by embracing data automation.

Seven out of 10 accounting firms already use cloud-based accounting and bookkeeping platforms; and while these platforms can make life a lot easier for CAS teams, their usefulness as general ledger and analysis tools is completely dependent on the accuracy and reliability of the data being fed into them.

That’s why, for now, the best solution for reducing this manual overload is for accounting firms to start using automated e-commerce data workflow solutions instead. These applications can automatically download daily, weekly, or monthly activity reports from a variety of e-commerce platforms, allowing for much easier completion of tasks such as reconciling sales, determining fees and service charges, and converting them into standard journal entries that can be imported into accounting and bookkeeping platforms.

Companies that use Bookkeep’s technology, for instance, can save their CAS professionals up to 20 hours per month, per client, resulting in substantial cost savings by eliminating lost staff time and outsourcing expenses.

Tax & accounting firms considering these solutions might want to start by conducting their own cost-benefit analysis. Have your CAS team keep track of all processes that require them to manually enter e-commerce data into your accounting system and the time they spend on these activities. This analysis should help you determine whether these manual bottlenecks are significant enough to justify investing in one or more automation tools.

Once you decide that automation is the way to go, choose a limited set of applications that will work with all of the e-commerce service providers your clients use. Make sure these tools can be fully integrated with the cloud-based accounting system you’re using now, and can be upgraded as e-commerce and accounting technologies evolve.

Perhaps at some point, we can hope that leaders in the e-commerce and accounting industries will come up with a set of universal standards for sales data reporting. They could model their efforts on the collaboration between the American Institute of Certified Public Accountants (AICPA) and key high-tech stakeholders in the 1990s that led to the development of XBRL, a standardized, open-source Internet language now used by financial institutions to produce and publish financial information.

In the meantime, tax & accounting firms might want to consider whether data automation applications will allow them to overcome the challenges that increasing levels of e-commerce activity presents, such as growing manual bookkeeping work and more potential errors. Indeed, they should look at increasing their automated process as ways of increasing tangible benefits, like lower employee attrition rates, reduced outsourcing costs, and greater bandwidth to take on more clients.

Most importantly, however, more automation offers more opportunities for CAS team members to grow professionally by giving them the time and confidence they need to serve as their clients’ strategic partners.