As the global trade market deals with a myriad of challenges all along its supply chain, trading pros increasingly are turning to technology to help them better manage their security and compliance

The global trade and supply chain market has seen upheaval in the past year, between Russia’s war in Ukraine, persistent high inflation, continuing regulatory tariffs, supply chain shortages and disruption, and more. That’s why it’s not a surprise that corporate trade and supply chain management’s strategic priorities have remained roughly static, according to the Thomson Reuters Institute’s 2023 Corporate Global Trade Report.

However, how corporations are approaching these strategic priorities is changing — and becoming more technologically-savvy. The report found that an increasing number of businesses are leveraging technology for global trade management (GTM), as the number of respondents now reporting they’re engaged in “early-stage” GTM technology use at 31%, a decrease of six percentage points compared to 2022, while those who said their GTM technology use is “established” increased four percentage points to 34%. And those respondents who indicated they’re “exploring emerging technologies” increased slightly as well, to 23%.

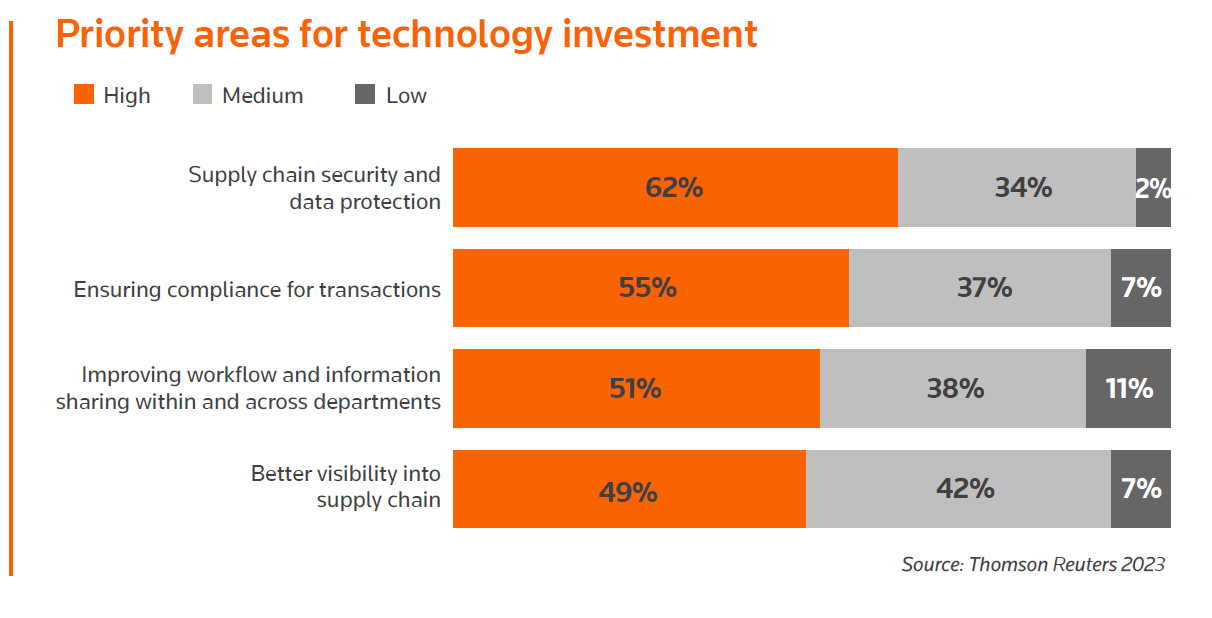

The imperative is clear from corporate trade and supply chain leaders: Technology is helping them achieve their top priorities. But it’s to what areas those technology investment dollars are going that provide interesting insight into where the future of supply chains may be headed, as companies increasingly focus on data security and privacy.

Securing the supply chain

Although the global trade function is increasingly investing in technology, that doesn’t mean that all companies necessarily have their own internal data in order. Only about half (49%) of respondents reported having an integrated system with visibility on trade across regions, while 29% reported having a partially integrated system, and 21% reported disparate systems for each region or business unit. About two-thirds (68%), meanwhile, reported being very satisfied or somewhat satisfied with the integration of trade systems and data throughout the company.

There was recognition among respondents, however, that visibility needs to increase. When asked about top priorities for investment, one respondent responded simply, “We need to have true and accurate data to drive better business decisions & compliance.” But another added an additional key reasoning behind that desire: “Data security is a huge priority simply because of the amount of data we use and store currently. The biggest issue [in my opinion] is finding a way to successfully stitch our various systems together globally.”

Indeed, among survey respondents, supply chain security and data protection ranked as the top priority area for increased technology investment.

The percentage of survey respondents pinpointing “supply chain security and data protection” as a high area of investment rose 8 percentage points between 2022 and 2023, overtaking “ensuring compliance for transactions” as the most commonly cited high-priority area. The high-priority focus on security and data protection also stayed consistent regardless of geography (more than 60% cited this in each of North America, Europe, and Latin America). These priorities are reflected in the data collected from suppliers as well, as 57% of companies overall reported collecting privacy data from suppliers — more than any other type of data.

This is perhaps unsurprising, given the increasingly integrated nature of the global economy and the role of the internet as a risk factor. A separate survey from software supply chain management company Sonatype has noted that the number of documented supply chain attacks involving malicious third-party components increased more than 700% between 2020 and 2023, topping 88,000 known instances last year.

Global trade respondents have gotten the memo, according to the Thomson Reuters Institute’s report. “Supply chain security and data protection need to be our highest [priority] at all times to protect us and the supplier,” answered one respondent.

Another offered: “Supply chain security and data protection are high priorities for my company because they help mitigate the risk such as theft, counterfeiting, and disruptions.”

For companies investing heavily in supply chain security, however, there may be more at play than simply risk mitigation. Some even see security and other data-related technologies as a potential business opportunity. When asked about top investment priorities, one survey respondent took a different approach to security, saying, “We always consider compliance, security, and proper innovation as key factors to distinguish our business from our competitors in the industry.”

The staffing solution

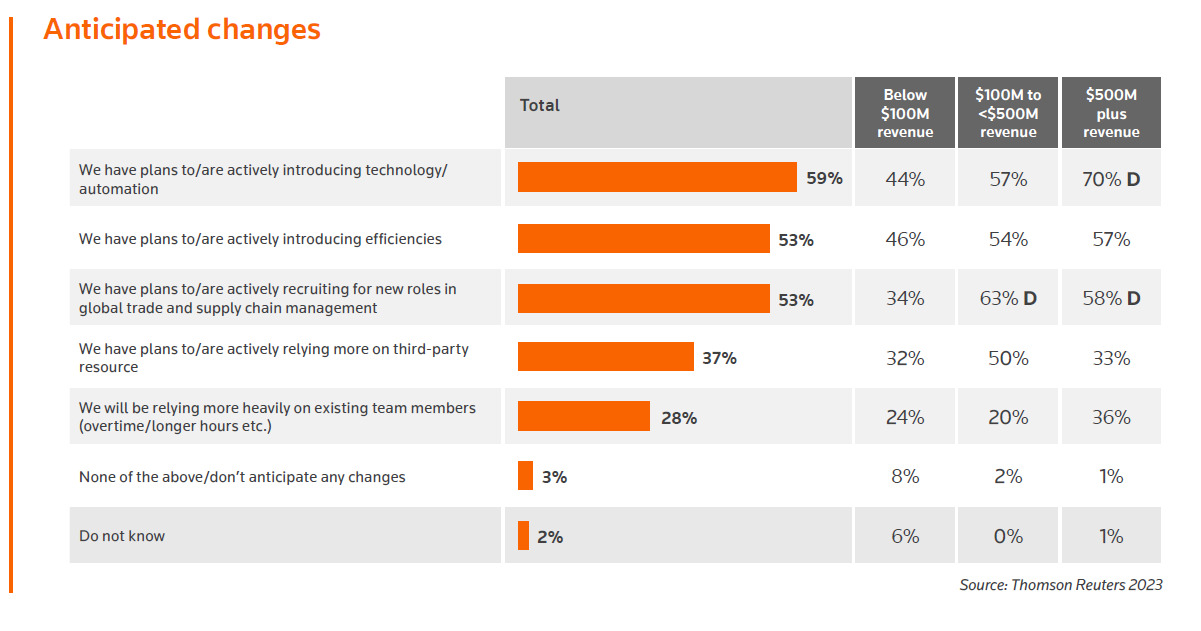

Even with security and innovation as top priorities, technology is often only as good as the people and processes allowing it to function. And there, corporate trade departments may run into some issues: One-third (33%) of respondents reported being under-resourced as to staffing in their department, including a worrying 44% of respondents at companies with more than $500 million in annual revenue.

In order to fill the gaps, companies also see technology as a possible answer. Nearly 60% of survey respondents said they have plans to or are actively introducing technology and automation to fight resourcing shortages. That percentage reaches 70% for the largest companies.

Will those technology investments provide the cover that some companies yearn for? Respondents mentioned a number of different areas with which they expect automation to help their supply chain. “The company is currently working on a fully automated barcoding system in line with shipping companies which alerts the second there is an issue,” answered one respondent.

“Investing in automation will increase our productivity,” another added. “Predictive analytics well help us plan for future operations. Different trade labels will help on fuel and overhead.” Other respondents even pointed to next generation technologies, with one noting: “Using AI [artificial intelligence] to anticipate needs and resource management is key to streamlining our logistic and procurement arms of the business.”

The global trade market continues to change in previously unforeseen ways, and in an increasingly complex regulatory and business environment, keeping data and security in order can also be easier said than done. However, it appears that many companies will continue to focus investment on data governance and security, particularly because it aligns the global trade department’s goals with that of the larger organization.

“Our big drive is towards efficiency to ensure our teams are working as best as possible,” explained one survey respondent. “We also have a strong integrity as a company, so we must ensure that this flows through our supply chain.”