As many law firms raise their rates even amid falling demand, are corporate clients really feeling this pinch, or are they moving work elsewhere and leaving larger law firms wanting?

One of the most dramatic, if not wholly unexpected, developments in the third quarter’s Thomson Reuters’ Law Firm Financial Index (LFFI) was the fall-off in demand in transactional practices — which includes corporate, tax, and real estate work — most notably in the merger and acquisitions (M&A) practice area. As we’ve stated, this has been especially painful for larger law firms, such as those in the Am Law 100, as they see more demand contraction because of the high level of transactional work they were doing at this time last year.

Interestingly, however, while larger firms also are seeing greater weakness in non-transactional practices, midsize law firms are finding real strength, which suggests that clients might be shifting work based on cost.

And it is upon that suggestion which we offer the following.

Inflation takes its toll

As the US Federal Reserve tried to tackle inflation over the last several months by raising interest rates, the cost of doing transactional deals, such as mergers, debt refinancing, or real estate transactions, greatly increased. And the uncertainty of the impact of those interest rate increases, and the specter of additional increases really killed clients’ appetite for those types of transactions, which then hurt law firms as well.

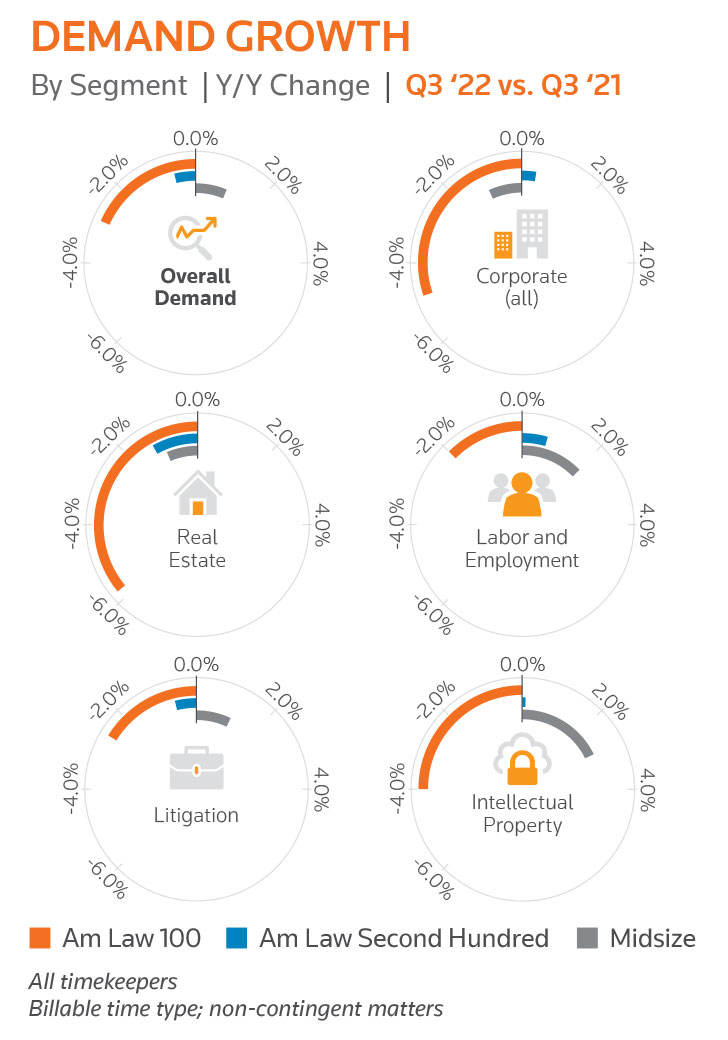

So, it’s not surprising in this first graphic that Am Law 100 firms are struggling so much, simply because transactional practice work is such a big part of their overall practice mix.

A comparison of overall demand growth from Q3 2022 to the same period in the prior year shows that both the Am Law 100 and the Am Law Second Hundred law firm segments had negative growth of -2.9% and -0.6%, respectively, while the midsize law firm segment had 1% positive growth. While much of this is due in part to the transactional area’s weakness, this trend is also seen in individual non-transactional practices that shouldn’t be impacted by the same macro-economic factors. And that suggests something more must be at play, and the other part of the story involves the level of growth in worked rates and how (or whether) those rate increases are being felt by clients.

Where the work is getting done

Around midyear, a statistic from Thomson Reuters Market Insights began making the rounds that showed about half of legal clients had adjusted their law firm rosters within the past year. So, you don’t have to go too far out on a limb to suggest that clients, in this inflationary environment, may be gravitating to lower-cost law firms, especially as rates continue to rise even as demand falls.

In Q3, we saw that law firms, regardless of size, raised their rates an average of 4.8%, roughly keeping pace with the first two quarters of the year. However, when we looked at data from another independent source — Thomson Reuters Institute’s Legal Department Operations (LDO) Index Survey, published in October — we get a vastly different perspective.

The LDO Index, which surveys corporate law department leaders and relies on Legal Tracker’s data, shows that these clients were seeing substantially less rate increases across the board than the LFFI data suggests. In fact, far from seeing a 4.8% rate increase law firms are charging year-to-date, corporate clients regardless of size have reported that the real growth rate they had experienced was much less and even was negative in some cases

How could this be? For the answer, we need an example to illustrate the phenomenon.

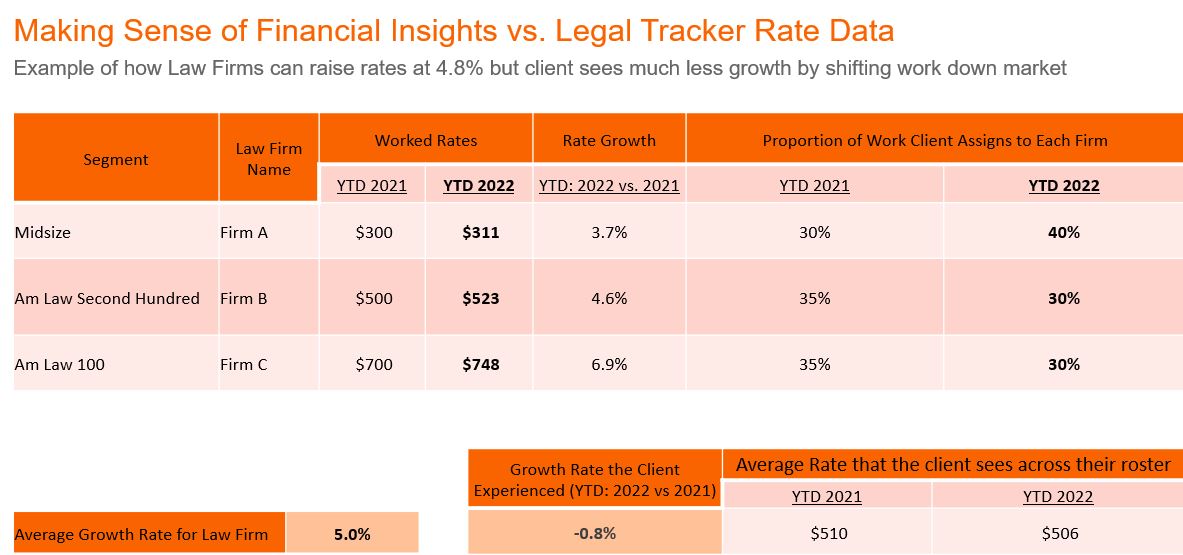

In this hypothetical situation, we can see how corporate clients could be deciding from which segment of the legal industry they’re purchasing their legal services. To illustrate, let’s say you’re a large corporate client and you have three law firms on your roster: one from the Am Law 100, one from the Am Law Second Hundred, and a midsize law firm.

Each one increased the rates it charges you for legal work (using current market benchmarks), with the larger firm requesting a larger increase of 6.9%. The Second Hundred firm increased its rates by 4.6% and the midsize firm by 3.7%.

However, if you, as a legal client, begin to shift your work matters downstream even a bit — say by moving 5% of your work from the Am Law 100 firm and 5% of work from the Second Hundred firm to the midsize firm, which would see its allocation increase by 10 percentage points, you could see a substantial cost savings. Indeed, you would be allocating more work to the firm that charges $311 per hour, rather than the ones charging $523 and $748 per hour, respectively.

That means, you would see the actual rates you are paying for legal services fall by 0.8%, as the chart shows, rather than experience rate increases nearer the industry average of 5%.

This strategy — applied more frequently throughout 2022 — may begin to explain our industry wide data divergence, as clients reported smaller or negative growth in their rates compared to the average law firm’s worked rate growth of 4.8% recorded in the third quarter and YTD.

Given this — and taking into account the shift in demand by law firm size segment, plus the high portion of clients that said they were adjusting their law firm rosters — it all seems to provide strong evidence that clients have begun shifting their legal work to lower priced firms, such as midsize law firms, and are likely to continue doing so into the future as more and more corporate law departments look to do more with less.