Law firms have a potential opportunity to gain business from Private Equity & Venture Capital firms, but they need to dispel certain myths about the work first

The Private Equity & Venture Capital space is at the center of many law firms’ strategic growth plans — and it’s little wonder why. These organizations spend on average, $35 million on outside counsel for fund- and deal-related work each year.

In its latest study with 100 U.S.-based Private Equity and Venture Capital (PE/VC) firms, Thomson Reuters interviewed both senior business leaders and General Counsel at PE/VC firms to see what it takes for a law firm to stand out with clients in this competitive space.

The results of this study exposed three pervasive myths about what it takes to win legal work with PE/VC firms.

Myth #1: Business leaders — not GCs — are solely responsible for hiring law firms

It’s time for law firms to let go of the long-held belief that General Counsel are not involved in deciding which outside law firms are hired for PE/VC related work. Different than other legal work types, there’s no denying the heavy involvement of senior business leaders (such as Directors and Managing Partners) when it comes to appointing counsel for fund- or M&A-related work.

However, nearly 90% of General Counsel are also involved in these same decisions. In fact, when comparing both sets of buyers, slightly fewer senior business leaders report being involved in appointing counsel for M&A work than do General Counsel.

For law firms, this means building out a strong position within the PE/VC sector requires establishing relationships with multiple decision-makers across these organizations.

However, the research shows that few law firms have figured out how to resonate with both types of buyers. Those firms that business leaders are thinking about top-of-mind differ from those that General Counsel name. Only four law firms — Cooley, Davis Polk, Kirkland & Ellis, and Latham & Watkins — have built strong enough mindshare with General Counsel and business leaders to sit among the Top 9 firms mentioned by both GCs and business leaders.

Myth #2: A prestigious brand reputation is the most important factor in the clients’ minds

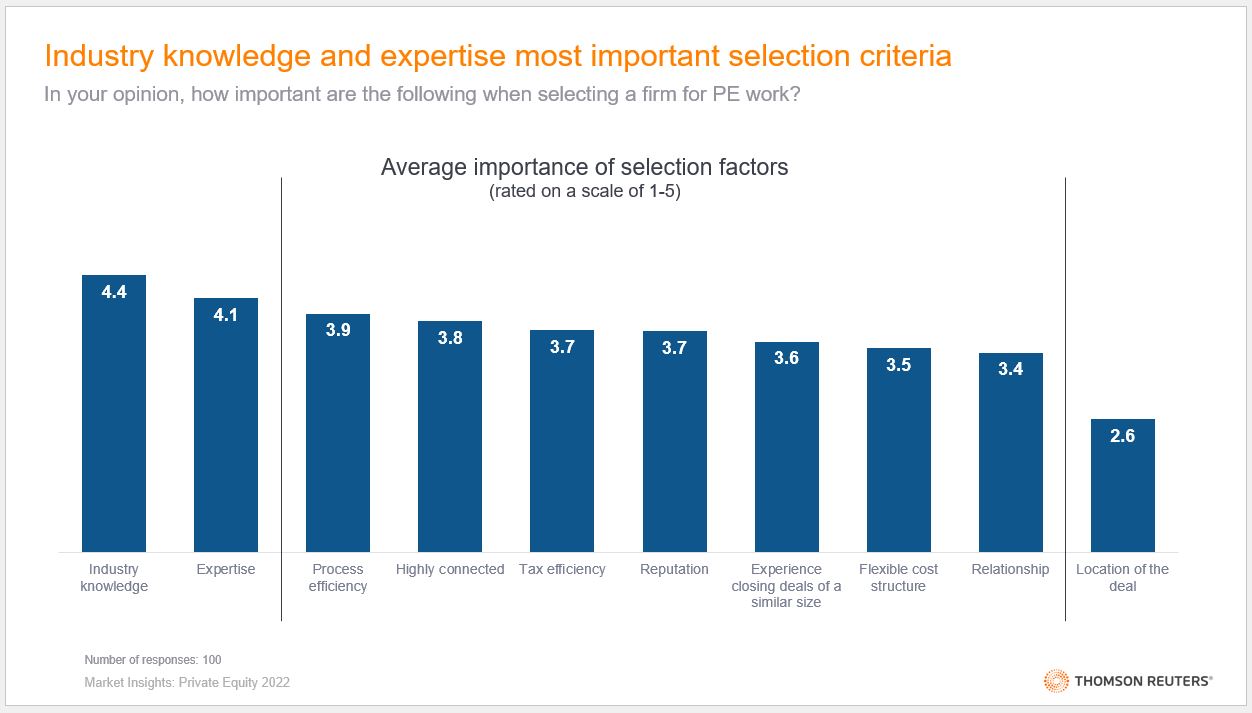

A strong reputation lands in the middle of the pack of what PE/VC clients say is important when selecting law firms for their PE-related work. So, what does it take to stand out with clients in the PE/VC space?

Out of 10 different factors, Industry Knowledge was rated as most important to PE/VC firms when selecting a law firm — even surpassing the importance of Expertise. Clients clearly are looking for firms that can demonstrate that they can tackle big-picture business concerns through a legal lens. Interestingly, this applies regardless of which PE/VC executive is doing the hiring. Both business leaders and GCs rate Industry Knowledge as the most important factor influencing their hiring of law firms.

Rounding out the top three areas rated by PE/VC clients as important is Efficiency. PE/VC firms undergo a high volume of deals each year — in this research, respondents had an average of 51 M&A deals and 87 funding transactions annually. Finding the right balance between quality and efficiency is a critical consideration for both business leaders and General Counsel when hiring for PE/VC work.

Many of the attributes asked about in the study saw similar ratings in importance, ranging from 3.4 to 3.9 on a scale of 1 to 5. However, there is one exception to this trend. On the bottom end of the spectrum, Location of the deal is rated substantially lower than the other factors in terms of importance to the hiring decision. This is likely welcome news to law firms that continue to weigh the pros and cons of investing in office space in an increasingly hybrid-working world.

Myth #3: Technology and Life Science & Healthcare are the top areas of investment for all PE/VC firms

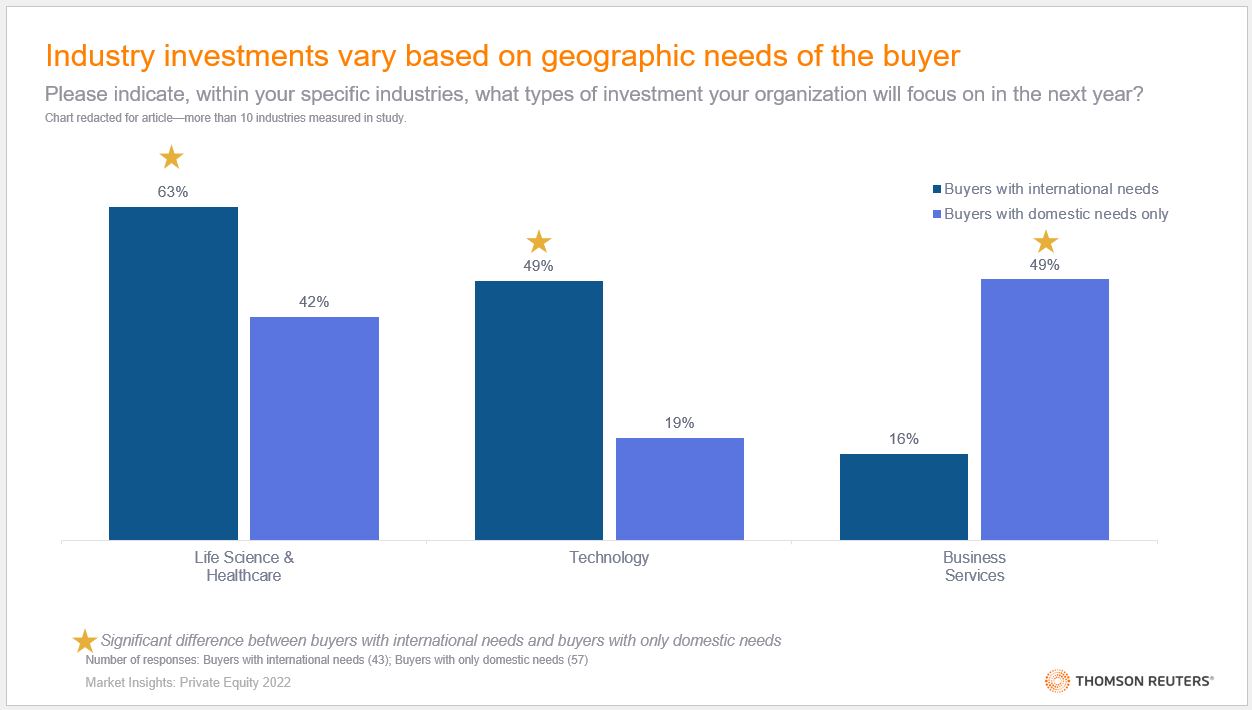

Despite some softening in the M&A space, the PE/VC market remains active. A number of industries are poised to be stronger investment considerations in 2023. For law firms looking to demonstrate their industry prowess to clients, it’s important to be aligned with the same sectors on which clients are focusing. But remember, not all clients are focused on the same industry segments.

PE/VC firms with an international scope have a different set of priority industries than those with a U.S. domestic-only focus. Internationally focused PE/VC firms are statistically significantly more likely to invest in the Life Science & Healthcare and Technology sectors. While U.S. domestically focused PE/VC firms are statistically significantly more likely to invest in the Business Services segment.

Note: The above chart was redacted to focus on key differences; more than 10 industries were included in the full analysis and study.

For law firms looking to win more work with buyers in the PE/VC space, these clear delineations are a good opportunity to create a targeted, industry-focused approach and build a differentiated position in certain segments.

The Private Equity/Venture Capital space is a unique one for law firms, but it’s important for law firms to dispel the myths that have historically surrounded what it takes to win work with clients in this space.

Receive exclusive access to the data behind the inaugural study into the US Private Equity/Venture Capital sector through a Market Insights subscription.