As we continue to look at the performance of the Midsize law firm segment at the midpoint of this year, we examine whether an increase in countercyclical demand can keep growing lawyer headcount from swamping productivity

The recently released Law Firm Financial Index (LFFI) report for the second quarter of 2023 highlighted a rebound in the growth of demand for law firm services, as measured by an increase in total billable hours, through the mid-point of this year. However, as the report detailed, this growth is not being felt across all law firm segments or practice areas.

In fact, Midsize law firms have drawn the majority of the benefit from the recovery of demand, at least so far this year.

The rise of countercyclical practices

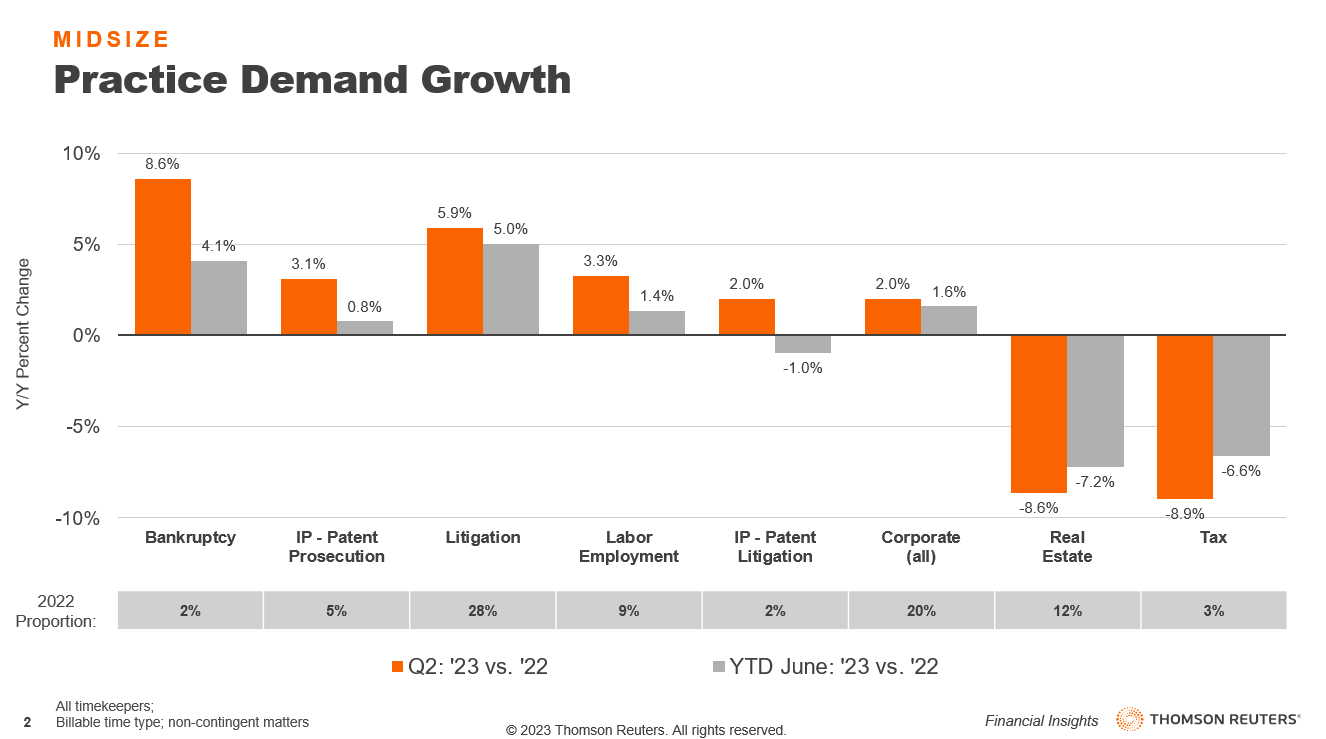

Much of this success is due to the segment’s strong performance in what we have termed countercyclical practices — those whose fortunes tend to run counter to the overall economic climate, including bankruptcy, labor & employment, and litigation practices. Across the legal industry, bankruptcy practices saw an average demand increase of 5.7% in Q2 2023, followed by litigation at 4.0% average growth, and labor & employment at 2.4%, according to the LFFI report.

We can, however, break those numbers down more specifically to examine how Midsize law firms in particular fared compared to these industry averages. Doing so unveils some interesting additional insight as well as some otherwise hidden strengths.

Bankruptcy

Perhaps chief among countercyclical practices, at least in terms of top-of-mind consideration, is bankruptcy, which as mentioned, saw average demand growth of 5.7% in the second quarter.

The average Midsize law firm far outpaced this mark, however, posting impressive growth of 8.6% in their bankruptcy work for the quarter. This, in turn, brought year-to-date growth in bankruptcy practices up to 4.1% for Midsize firms, indicating that bankruptcy work is not only strong for that particular segment, but it may in fact be accelerating.

Litigation

While litigation posted a strong Q2 across all law firm segments, once again Midsize law firms enjoyed a position on the strong side of the average. The average Midsize law firm grew their litigation demand by an impressive 5.9% in the second quarter of the year, leading to 5.0% growth YTD.

Quarterly growth was bolstered somewhat by a slightly deflated 2022 baseline, as litigation in Q2 2022 contracted by 1.0% for the average Midsize firm. Yet even accounting for this softer baseline, the performance of Midsize litigation practices through midyear 2023 is indicative of real growth. Moreover, litigation tends to be a relatively lucrative practice that can be less susceptible to price sensitivity on the part of the client, at least to a certain level.

It is difficult to say how long the high tide of litigation work might last, but given that the economy remains unsettled, courts continue to work their way through a pandemic-driven backlog of cases, and Q2 litigation demand growth drove YTD practice demand performance up, it seems likely that litigation practices may be on the upswing for at least the foreseeable future.

Labor & employment

Labor & employment practices were perhaps the softest of the countercyclical practices for Midsize law firms compared to the market as a whole. The all-segments average growth for labor & employment practices was 2.4% in Q2 and 1.8% YTD.

In comparison, Midsize law firms grew their labor & employment demand by 3.3% for the quarter, but only 1.4% YTD.

For the average Midsize law firm, strong Q2 labor & employment performance would be encouraging. However, there is a question as to why the segment underperformed the market-wide average so far this year, albeit only slightly. That question notwithstanding, the fact that Q2 posted comparatively strong performance should be encouraging for leaders of Midsize law firms. Those same leaders would do well to explore whether they are doing all they can to capture labor & employment market share in a time of otherwise volatile demand for law firm services.

Corporate and transactional practices

General corporate practices could almost have been characterized as a sort of countercyclical practice for Midsize firms through the midyear point, although not as we’ve previously defined them.

Corporate work is certainly not generally characterized as a countercyclical practice, nor would we typically categorize it as such. However, corporate work for Midsize law firms has been following a sort of countercyclical pattern, at least lately.

While general corporate work has been flat for the average law firm (and contracting for the largest firms), it grew by 2.0% in Q2 2023, and 1.6% YTD for Midsize law firms.

Given the overall state of the economy, it seems unlikely that this is what we might characterize as net new legal work, or work that has not previously been performed by another law firm. Instead, it seems likely that this is yet another indication of the strength of the phenomenon of demand mobility, which we have written about previously.

This growth in corporate work was not enough to stave off overall contraction for Midsize law firms’ transactional practices, which contracted by 1.1% in Q2 2023, per the LFFI. However, it did help to place Midsize law firms in the strongest relative position of all tracked market segments. By contrast, Am Law 100 and Second Hundred law firms saw their transactional practices contract by 3.7% and 3.4%, respectively, for the quarter.

The impact of increasing headcount

Midsize law firms not only led the market in growth in several key practices, however, as discussed in the previous post in this series, the segment also led in lawyer headcount growth through the midpoint of the year, adding 5.1% more lawyers on average compared to Q2 2022.

The net effect of this growth in headcount blunted much of what could have been a very positive impact for Midsize law firms in terms of productivity. Even with positive performance spread across a number of practices, average demand growth of 2.8% was overshadowed by headcount increases, resulting in a 2.4% contraction in Midsize law firm productivity in Q2 2023.

Each individual firm will provide distinct and varied explanations for adding headcount, ranging from a continued need to improve leverage to a plethora of talented lawyers extricating themselves from the ranks of larger law firms and more. However, Midsize law firm leaders should ensure that growth in headcount is being handed in a thoughtful way as to minimize the potential negative impact it may have on lawyer productivity.

Further, as we will discuss in an upcoming series installment, each of these new hires adds a sizeable burden to the expenses side of a firm’s ledger, a factor which has an unavoidably negative impact on potential firm profitability.

Thus far, 2023 has placed Midsize law firms in a favorable position to retain their crown as industry demand-growth champions. A careful balancing of other strategic priorities can help leaders of these Midsize law firms translate this success into more broadly positive financial results.